The cellulose acetate market is witnessing significant transformation as industries increasingly prioritize sustainable and biodegradable alternatives to traditional plastics. Derived from natural cellulose sources such as wood pulp and cotton, cellulose acetate stands out as a biodegradable polymer with diverse applications. The current market scenario reflects a rising demand driven by environmental regulations, consumer awareness, and innovation in end-user industries.

Market Dynamics and Growth Drivers

One of the primary growth drivers in the cellulose acetate market is the escalating demand for eco-friendly materials. As concerns over plastic pollution and carbon emissions mount, both consumers and regulatory bodies are pushing for biodegradable and compostable materials. Cellulose acetate, being plant-derived and biodegradable, has emerged as a favorable alternative to petroleum-based plastics.

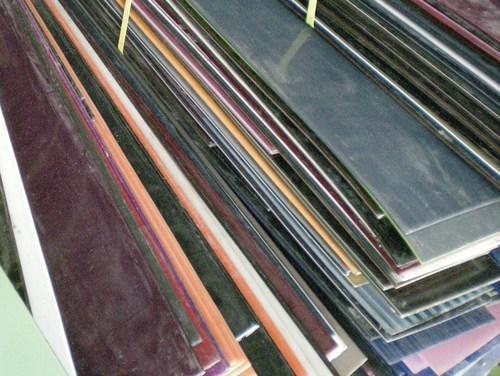

In addition, the product’s versatility contributes to its market strength. Cellulose acetate is used in applications ranging from cigarette filters and textiles to eyewear frames, films, and packaging materials. In particular, the cigarette filter segment holds a substantial share of the market due to cellulose acetate's filtration efficiency and biodegradability compared to synthetic alternatives. However, as tobacco regulations tighten and the demand for cigarettes fluctuates globally, this segment faces both opportunities and constraints.

The fashion and textiles industry is also seeing a resurgence in the use of cellulose acetate, especially for eco-conscious apparel and accessories. Its silky texture, dyeability, and breathability make it an attractive fabric component. Moreover, manufacturers are investing in R&D to develop cellulose acetate-based fibers and blends that align with the circular economy.

Regional Market Insights

Geographically, the Asia-Pacific region dominates the global cellulose acetate market, primarily due to strong production capabilities in countries like China and India. These nations benefit from readily available raw materials, low manufacturing costs, and a growing domestic demand across various applications. Moreover, rapid urbanization and industrialization contribute to increased consumption.

North America and Europe also represent significant market shares. In these regions, environmental awareness, stringent regulations, and high disposable income drive the uptake of sustainable materials. The demand for biodegradable packaging, especially in the food and beverage sector, has spurred investments in cellulose acetate innovations.

Meanwhile, emerging economies in Latin America and Africa are witnessing gradual market development, largely supported by the global shift toward sustainability and external investments in green technology and infrastructure.

Challenges and Market Restraints

Despite the favorable outlook, the cellulose acetate market faces certain challenges. The high production cost relative to some synthetic alternatives can limit adoption, especially in price-sensitive sectors. Additionally, raw material availability and price fluctuations can influence manufacturing economics and profit margins.

Technological limitations in large-scale biodegradability and recycling infrastructure can also restrict cellulose acetate’s potential. While it is biodegradable, its decomposition rate varies based on environmental conditions, which has prompted criticism from some environmental groups.

Moreover, the ongoing transition from cellulose acetate-based cigarette filters to newer biodegradable alternatives, such as PLA and other bio-polymers, may impact the demand for cellulose acetate in its largest application segment. This shift necessitates product innovation and diversification to sustain market growth.

Future Outlook and Opportunities

The future of the cellulose acetate market lies in innovation, regulation, and partnerships. Companies are exploring ways to enhance biodegradability, reduce production costs, and improve performance properties. Advancements in green chemistry, enzymatic processing, and bio-based plasticizer formulations are paving the way for high-performance cellulose acetate derivatives.

Sustainability policies worldwide, including bans on single-use plastics and incentives for biodegradable materials, are likely to open new avenues for cellulose acetate in packaging, agriculture, and consumer goods. Strategic collaborations between chemical manufacturers, research institutions, and governments could further strengthen market prospects.

In addition, the integration of cellulose acetate into advanced manufacturing methods, such as 3D printing and biocomposites, presents exciting opportunities for future growth. Its compatibility with other biodegradable polymers and its ability to be molded into various forms enhance its potential across new-age industries.

Conclusion

The cellulose acetate market is evolving in response to global sustainability trends and material innovation. While challenges remain, particularly in cost and end-of-life processing, the material's biodegradability and functional versatility ensure its continued relevance. As industries adapt and invest in green technologies, cellulose acetate is poised to play a central role in the bio-based materials landscape of the future.