API Banking Market Forecast Predicts Strong Growth Driven by Open Finance and Digital Integration

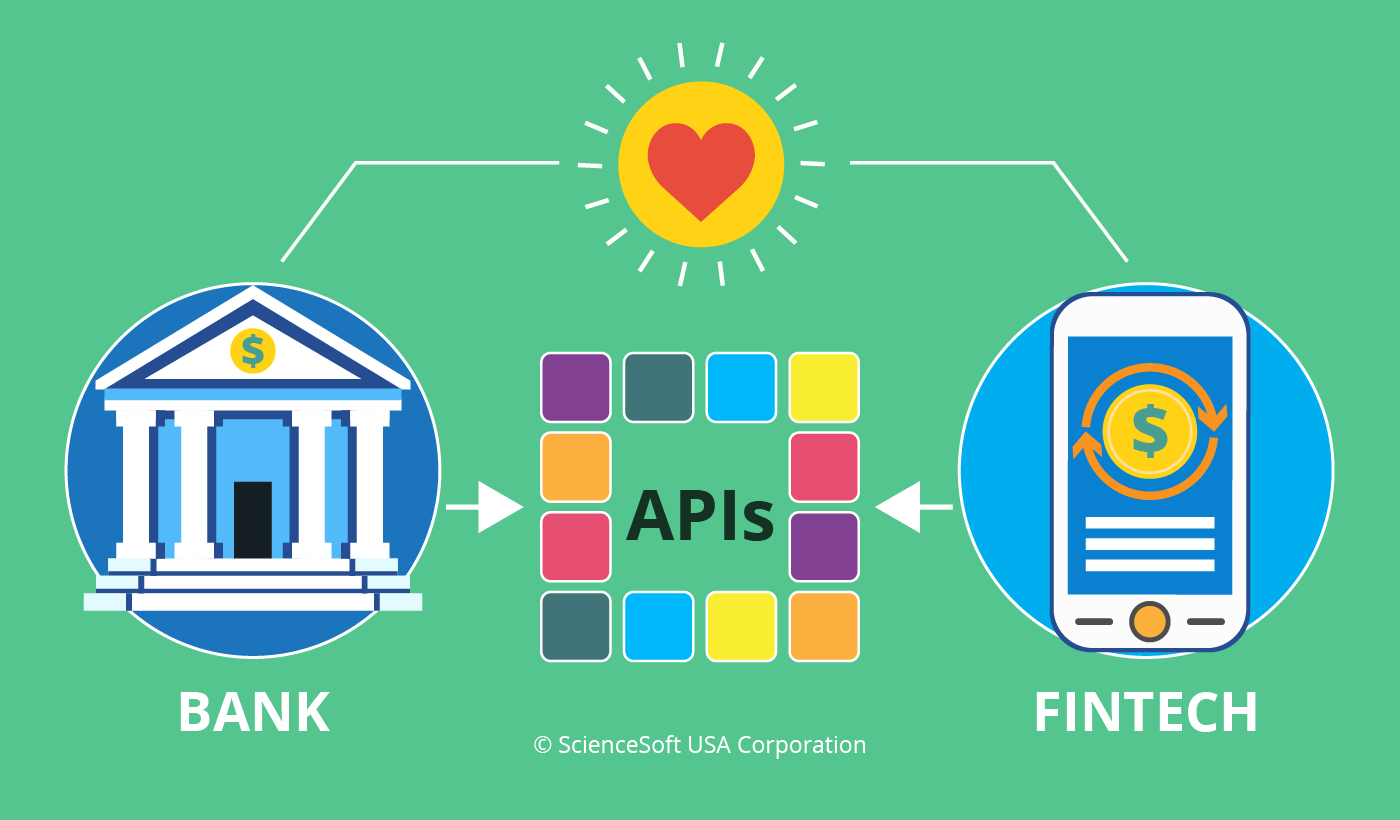

The API banking market is on a trajectory of substantial growth, driven by accelerating digitalization, evolving customer expectations, and regulatory support for open finance. As banks continue to modernize their systems and partner with fintech companies, APIs are emerging as the essential infrastructure supporting the future of banking. The forecast for the API banking market signals robust development in both scale and complexity, with global financial ecosystems becoming more interconnected and service-driven.

A significant factor shaping the API banking market forecast is the increased adoption of open banking frameworks. Governments and regulatory bodies across Europe, North America, and Asia-Pacific have introduced policies that encourage or mandate banks to provide access to customer financial data—through secure APIs—to authorized third-party providers. This trend has expanded the use cases for APIs beyond simple data sharing, facilitating a broader movement toward open finance.

According to market trends, the API banking segment is expected to grow at a fast pace over the next several years. With traditional financial institutions increasingly seeking digital agility, the demand for standardized, secure, and scalable APIs is rising. APIs allow banks to unbundle their services and offer them through external platforms, enabling a Banking-as-a-Service (BaaS) model that extends their reach far beyond traditional customer touchpoints.

BaaS will be a central pillar of future growth. The forecast indicates that non-banking entities—such as e-commerce businesses, travel platforms, and gig economy apps—will continue to adopt embedded finance solutions powered by API infrastructure. Through this model, businesses can integrate banking features like payments, loans, and digital wallets directly into their customer experiences. This not only improves user satisfaction but also creates new revenue channels for both banks and platform partners.

Another key insight from market projections is the increasing role of real-time services. Customers now demand instant account opening, real-time fund transfers, and immediate transaction alerts. APIs make it possible to deliver these capabilities across multiple platforms and channels. In the coming years, real-time banking services will become a baseline expectation, and financial institutions that lack API integration will struggle to stay competitive.

From a technological standpoint, advancements in artificial intelligence and cloud computing will enhance the performance and capabilities of API banking. AI-powered APIs will enable banks to offer smarter financial services such as predictive analytics, automated compliance monitoring, and intelligent fraud detection. Cloud infrastructure, on the other hand, will provide the scalability required to handle large volumes of API calls while ensuring consistent performance and security.

The forecast also emphasizes the rise of API marketplaces. These digital hubs will serve as platforms where banks and third-party developers can access, share, and monetize APIs. API marketplaces are expected to become a key enabler of innovation, simplifying the development of new financial products and streamlining partnerships between banks and fintechs.

Security and compliance will remain top priorities throughout the forecast period. As more APIs are deployed and integrated into banking ecosystems, the risk surface for cyberattacks grows. To mitigate these risks, institutions will invest in robust API management platforms that include advanced authentication protocols, traffic monitoring, rate limiting, and encryption. Compliance with regional and international data protection regulations will also drive API design and deployment practices.

Geographically, North America and Western Europe will continue to lead in terms of adoption and innovation, owing to strong regulatory frameworks and high digital maturity. However, emerging markets in Asia, Africa, and Latin America will see the fastest growth rates due to expanding mobile penetration, digital banking adoption, and supportive government initiatives. These regions will provide fertile ground for API-powered financial services aimed at improving financial inclusion and customer access.

Furthermore, the growing collaboration between banks and technology providers will fuel innovation across the API banking landscape. Established financial institutions are forming alliances with fintechs and cloud service providers to co-create digital products, test new services in sandbox environments, and scale successful offerings rapidly through APIs. This cooperative ecosystem will be critical to maintaining competitive advantage in a rapidly evolving market.

In conclusion, the API banking market forecast points to a dynamic and transformative future. APIs are no longer optional—they are foundational components of modern banking infrastructure. The next decade will see a surge in open finance initiatives, deeper integration of financial services into everyday platforms, and greater personalization driven by data and automation. As banks embrace these changes and invest in API strategies, they will be well-positioned to lead the digital banking revolution and deliver next-generation financial experiences.