Future of the Global Marine Lubricants Market 2024–2032: Trends, Opportunities, and Challenges

Market Overview

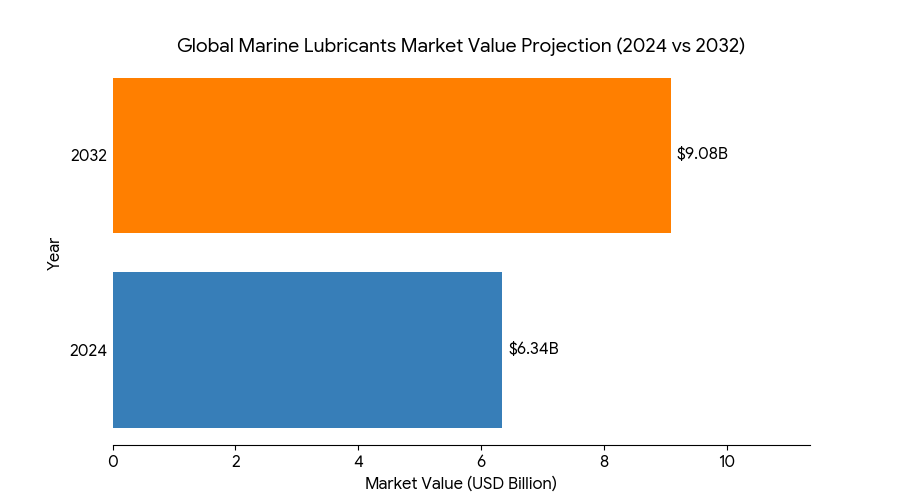

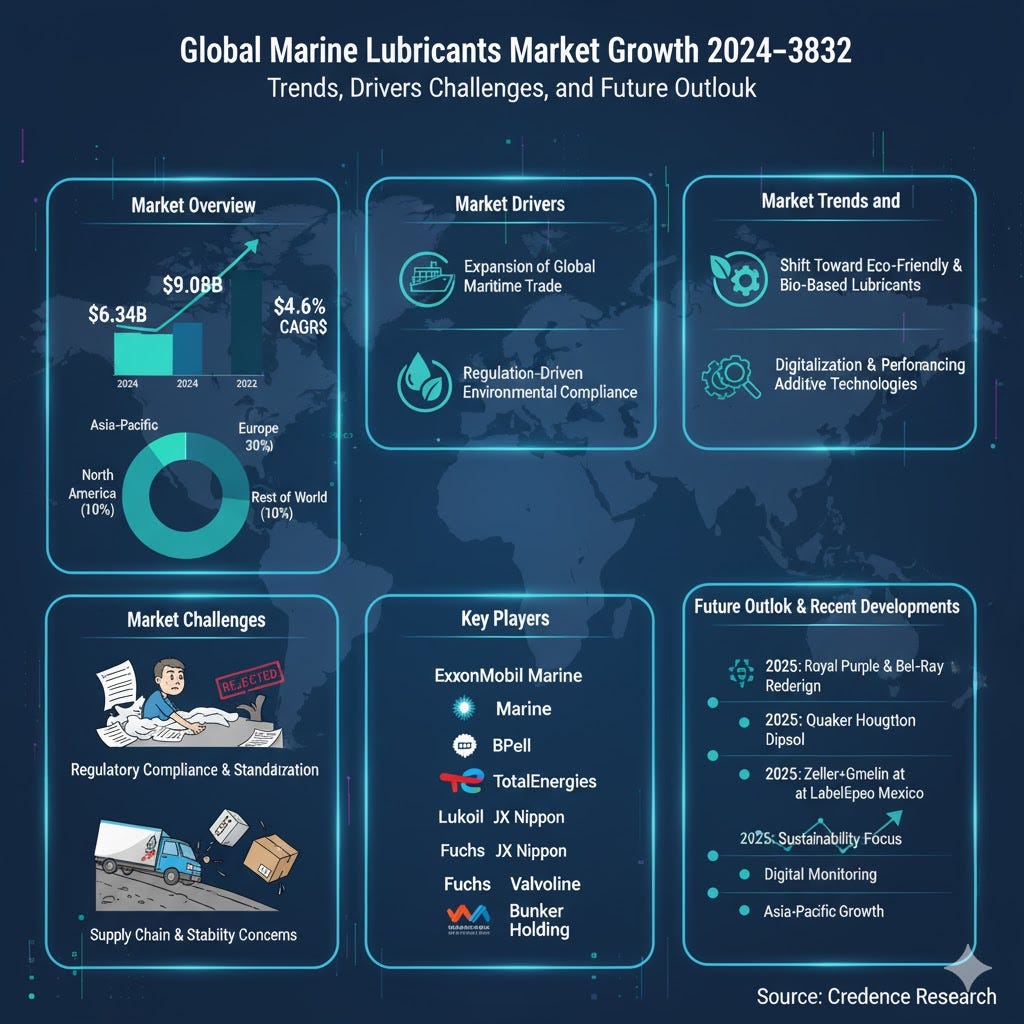

According to Credence Research, the marine lubricants market stood at approximately USD 6.34 billion in 2024 and will rise toward USD 9.08 billion by 2032 with a compound annual growth rate of about 4.6%. Demand grows due to increasing global shipping activity, expanding trade routes, and stricter environmental regulations such as IMO 2020, which push uptake of eco-friendly and low-sulfur lubricant formulations. Advances in additive technologies enhance performance under extreme marine conditions, and operators emphasize operational efficiency to reduce downtime, lower costs, and extend engine life. Asia-Pacific dominates the market share, followed by Europe and North America.

Source: https://www.credenceresearch.com/report/marine-lubricant-market

Market Drivers

Expansion of Global Maritime Trade and Fleet Modernization

Growing volumes of containerized and bulk goods trade fuel expansion in vessel operations, which increases demand for marine lubricants. Credence Research reports operators invest in new vessels and retrofit existing fleets, which forces lubricant suppliers to deliver formulations compatible with modern engines. It improves engine longevity, reduces friction, and thereby lowers maintenance costs. Vessel owners, both commercial and naval, push for lubricants that endure harsh operating environments. It strengthens demand for high performance base oils and additives tailored to newer engine designs. Growing offshore energy projects also require specialized lubricants.

Regulation‐Driven Environmental Compliance and Technical Innovation

Stricter international rules like IMO 2020 force marine operators to use low-sulfur fuels and lubricants that comply with environmental safety norms. Credence Research notes increasing interest in bio-based and environmentally acceptable lubricants (EALs) to reduce emissions and pollution. It stimulates R&D in additive technologies to improve thermal stability, corrosion resistance, and fuel compatibility. Engine manufacturers demand lubricants that maintain efficiency while meeting emissions and biodegradability standards. Suppliers respond with formulations that balance cost, performance, and compliance. It pressures manufacturers to optimize raw material sourcing and adapt to regional regulatory variation.

Market Trends and Opportunities

Shift Toward Eco-Friendly and Bio-Based Lubricants

Credence Research finds rising adoption of lubricants derived from renewable raw materials, biodegradable and non-toxic base oils, and those satisfying EAL and IMO environmental standards. Operators focus on minimizing marine pollution while maintaining engine protection and fuel efficiency. It promotes growth in product lines that reduce sulfur content, lower toxicity, and degrade more rapidly in the environment. Manufacturers invest in formulation science to ensure performance under high temperatures and pressure. Ports and regulatory bodies in Europe, North America, and Asia-Pacific increase compliance checks for such lubricants, which opens new market niches.

Digitalization and Performance-Enhancing Additive Technologies

Credence Research reports manufacturers enhance product value through advanced additive blends that resist wear, heat, and deposits in modern marine engines. Real-time monitoring tools allow operators to track lubricant condition and engine performance. It enables predictive maintenance, so fleets can reduce downtime and extend lubrication intervals. Smart sensors and digital condition-monitoring systems become differentiators among suppliers. It creates opportunities for service-focused contracts rather than commodity sales. It fosters partnerships between lubricant producers and technology providers.

Market Challenges

Regulatory Compliance Costs and Regional Regulatory Heterogeneity

Market producers face similar pressures when meeting evolving environmental rules, although comparison is limited. Marine lubricant manufacturers incur high costs for formulating low-sulfur, eco-friendly and bio-safe products. It demands continuous investment in testing, certification, and raw material sourcing. Different regions follow diverse regulatory regimes, which complicates standardization and increases logistical complexity. It burdens smaller players that lack economies of scale. Frequent updates in regulation force frequent reformulations, which carry financial risk.

Raw Material Price Volatility and Supply Chain Risks

Market research illustrates the impact of volatile input costs; similarly, marine lubricant producers face fluctuating prices for base oils, additives, and raw materials tied to crude oil markets. It disrupts cost forecasting and squeezes profit margins when passing costs to customers becomes difficult. Global supply chain disruptions amplify delays and raise transportation costs. Dependence on certain specialized base oils or additives subjects manufacturers to shortages. It forces firms to seek diversified supply sources and build more resilient logistics networks.

Competitive Analysis

Marine Lubricants Market Market features strong competition among global oil companies and specialist lubricant firms. It includes key players like ExxonMobil Marine, Shell Marine Products, TotalEnergies SE, BP plc, Chevron Marine Products, Lukoil Marine Lubricants, Fuchs Petrolub SE, JX Nippon Oil & Energy, Valvoline Inc., and Bunker Holding A/S. Major players differentiate via innovation in formulation (additives, eco-compliance), global blending and supply networks, port presence, hybrid fuel compatibility, and service offerings like condition monitoring. It intensifies pressure on smaller firms to innovate and maintain cost efficiency. Technological leadership and regulatory compliance serve as key competitive levers in the market.

Go-To-Market Strategy

Marine Lubricants Market Market participants must focus on building strong port-side relationships and comprehensive distribution networks to ensure product availability at major global bunkering hubs. It proves essential to partner with engine OEMs and shipbuilders to validate lubricant compatibility with modern propulsion technologies. Suppliers should invest in R&D for eco-compliant formulations to meet regulatory requirements and differentiate offerings. It helps to bundle technical service, lubricant condition monitoring, and after-sales support to offer total value rather than mere product. Pricing strategy must balance performance premiums with cost pressures from feedstocks. It works well to tailor products and marketing to regional regulatory norms and emerging markets, especially in Asia-Pacific.

Future Outlook

The marine lubricants market will likely embrace sustainability more deeply, with increasing demand for bio-based, biodegradable, and low-toxicity formulations. Environmental mandates such as IMO regulations will continue to push manufacturers toward innovation that balances emissions control and engine protection. Fleet modernization and adoption of alternative fuels will drive requirement for lubricants compatible with varied thermal, sulfur, and pressure profiles. Digital tools for monitoring lubricant condition will become standard, reducing waste and extending service intervals. Asia-Pacific will remain centre of consumption and innovation, while Europe will lead in regulation-driven eco-compliance. Manufacturers that invest in resilient supply chains and additive technologies will secure competitive advantage.

Recent Developments

In July 2025, Royal Purple and Bel-Ray introduced a redesigned one-gallon bottle that is more durable, eco-friendly, and ergonomically enhanced, featuring a wider neck for improved pouring efficiency.

In March 2025, Quaker Houghton completed the acquisition of Dipsol Chemicals Co., Ltd., a prominent provider of surface treatment and plating solutions, strengthening its portfolio of advanced industrial solutions.

Also in March 2025, Zeller+Gmelin announced its participation in LabelExpo Mexico 2025, where it plans to showcase its high-performance NUVAFLEX® UV/LED curing inks and unveil the new 16 Series UV/LED ink scheduled for launch in Summer 2025.

Source: https://www.credenceresearch.com/report/marine-lubricant-market