North America Inorganic Pigment Dispersion Market Overview: Demand, Segmentation, and Forecast

Market Overview

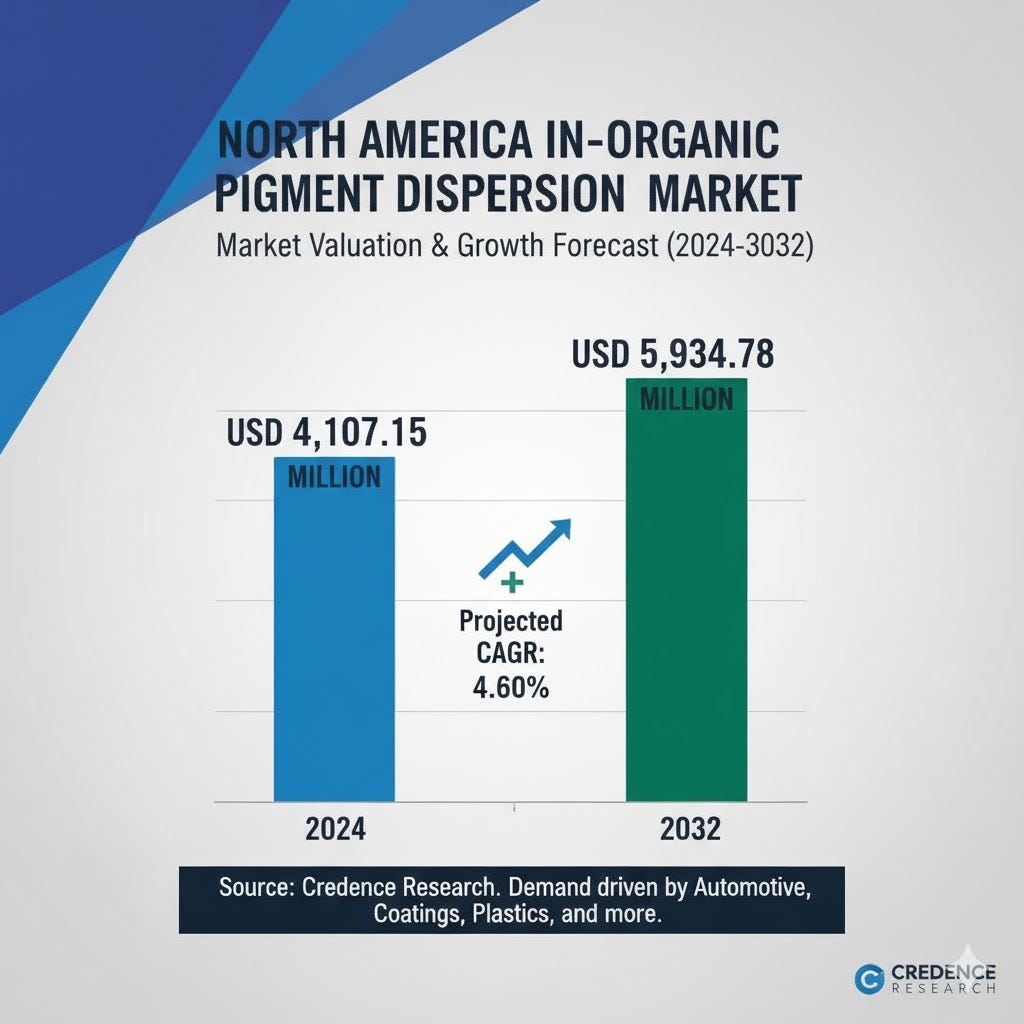

The North America In-Organic Pigment Dispersion Market was valued at USD 4,107.15 million in 2024 and exhibits a projected CAGR of 4.60%, with forecasts reaching USD 5,934.78 million by 2032, as per Credence Research. Demand from automotive, construction, packaging, and printing inks supports steady growth because dispersions deliver color stability, weather resistance, and process efficiency. Regulatory pressure pushes suppliers toward non-toxic, low-VOC formulations and eco-certified products, while technological advances in milling and digital color matching raise product performance. The United States leads regional consumption, supported by strong manufacturing and infrastructure activity.

For More: https://www.credenceresearch.com/report/north-america-in-organic-pigment-dispersion-market

Market Drivers

Industrial Demand and Application Pull

The North America In-Organic Pigment Dispersion Market expands on rising use across automotive, construction, packaging, and printing ink sectors. It supports durable finishes and consistent color at scale, improving product differentiation. Procurement teams favor suppliers that deliver compliant, heavy-metal-free dispersions, which strengthen long-term contracts. Investment in high-performance dispersions that tolerate heat and light boosts adoption in outdoor coatings. Manufacturers pursue process efficiencies to reduce waste and lower total cost of ownership. Regulatory compliance and urban infrastructure projects sustain steady commercial volumes.

Technology and Sustainability Focus

Demand for premium pigment dispersions grows with advances in milling, stabilization, and digital color tools. It enables finer particle distribution and consistent batches that meet strict OEM standards. Firms that adopt renewable raw materials and low-VOC formulations improve market access with eco-conscious buyers. Strategic R&D into functional pigments opens specialty segments such as aerospace and electronics. Scale players gain advantage through automated production and faster custom color matching. This combination of tech and green credentials strengthens supplier differentiation and margins.

Market Trends and Opportunities

Customization and Digital Tools

The North America In-Organic Pigment Dispersion Market shifts toward tailored pigment systems for industry-specific palettes and substrate compatibility. It helps brands achieve unique finishes and supports fast turnaround for bespoke orders. Digital color-matching and automated dispense systems reduce human error and shorten lead times. Suppliers that integrate smart manufacturing capture repeat business from large converters and OEMs. Expansion into 3D printing and specialty coatings presents new revenue streams for developers of high-performance dispersions.

Sustainability and Functional Applications

Interest in eco-certified, recyclable, and bio-based raw materials creates openings for next-generation dispersions with low environmental impact. It aligns procurement with stricter environmental standards and buyer preferences. Opportunities also exist in smart coatings, solar, and electronic films that require pigments with thermal or conductive properties. Partnerships with raw-material providers and investment in circular practices strengthen supply resilience and brand positioning. Companies targeting these niches can secure premium pricing and long-term contracts.

Market Challenges

Cost Volatility and Supply Risk

The North America In-Organic Pigment Dispersion Market faces pressure from volatile raw material prices for minerals, solvents, and additives. Procurement unpredictability complicates contract negotiations and squeezes margins for smaller producers. Logistical disruptions increase lead times and inventory costs. Maintaining consistent quality under price strain challenges process control. Smaller suppliers struggle to absorb cost shocks and meet large OEM demands. Strategic sourcing and backward integration remain crucial risk-mitigation levers.

Competition and Regulatory Burden

Intense competition forces pricing pressure and consolidation within the North America In-Organic Pigment Dispersion Market, reducing differentiation for commoditized grades. Stricter environmental rules raise compliance costs and limit certain pigment chemistries, requiring sustained R&D investment. Smaller firms find it hard to fund necessary innovation and certification. Buyers increasingly request documented sustainability credentials, increasing supplier onboarding friction. Companies must balance investment in green chemistry with near-term profitability to stay competitive.

Key Players

· BASF

· Clariant

· LANXESS

· Venator

· Tronox

· Kronos Worldwide

· Cabot Corporation

· Heubach Group

· Ferro Corporation

· DIC / Sun Chemical

Regional Insights

United States (62%) The U.S. leads demand due to robust automotive, packaging, and construction industries, strong manufacturing base, and large coatings sector.

Canada (23%) Canada shows steady growth driven by construction and sustainability adoption in coatings and specialty applications, supported by regulatory incentives.

Mexico (15%) Mexico grows fastest in manufacturing and automotive investment, attracting foreign firms and boosting pigment dispersion consumption.

Competitive Analysis

The North America In-Organic Pigment Dispersion Market shows consolidation toward large, integrated chemical players that combine scale, R&D, and sustainability credentials. It rewards firms that offer consistent quality, digital color services, and eco-certified products. Key players such as BASF, Clariant, LANXESS, Tronox, and Cabot leverage distribution networks and technical support to win OEM contracts. Smaller specialists compete on tailored solutions and niche functional pigments. Price competition persists for commodity grades, so differentiation through service, green certifications, and application development remains decisive.

Go-To Market Strategy

To enter the North America In-Organic Pigment Dispersion Market effectively, target high-value verticals such as automotive, packaging, and industrial coatings with application trials and joint development projects. Offer digital color matching, fast sample labs, and on-site technical support to shorten adoption cycles. Emphasize eco-certification and low-VOC formulations in sales messaging to meet procurement requirements. Build regional distribution partnerships to ensure logistics reliability and local inventory. Use pilot contracts and performance guarantees to convert converters and OEMs, then scale through long-term supply agreements and co-innovation programs.

Recent Developments

1. February 2025 LANXESS launched Bayferrox micronized iron oxide yellow pigments with 35% lower carbon footprint for North American coatings.

2. Clariant implemented precision-controlled milling and advanced dispersion techniques to improve particle distribution and reduce waste.

3. Dynamic Color Solutions introduced automated color-dispensing systems for precast concrete and custom blends, accelerating order turnaround.

4. Atomic Layer Deposition technology found new applications in aerospace and electronics coatings, enhancing durability and adhesion.

5. Suppliers adopted renewable raw materials and circular practices to meet regulatory and sustainability demands.

Future Outlook

Demand will broaden beyond traditional paints and plastics into specialty and functional applications such as electronics, solar films, and 3D printing, while sustainability and digital service offerings will determine premium positioning and long-term supplier success. The market will witness rising investments in R&D for smart pigment formulations that enhance energy efficiency and visual performance. Expansion of eco-friendly coatings and advancements in automation will redefine production standards. Strategic collaborations between raw material suppliers and pigment manufacturers will further strengthen innovation pipelines, enabling companies to capture emerging opportunities across North American manufacturing and infrastructure development sectors.

Frequently Asked Questions

What is the current market size of the North America In-Organic Pigment Dispersion Market?

The market size stood at USD 4,107.15 million in 2024, as per Credence Research.

Which country leads the regional market?

The United States leads with approximately 62% share of North American demand.

What pigment type held the largest share in 2024?

Titanium dioxide captured the highest share at about 38% in 2024.

What major trend should suppliers prioritize?

Suppliers should prioritize eco-certified dispersions and digital color services to secure OEM contracts.

For More: https://www.credenceresearch.com/report/north-america-in-organic-pigment-dispersion-market