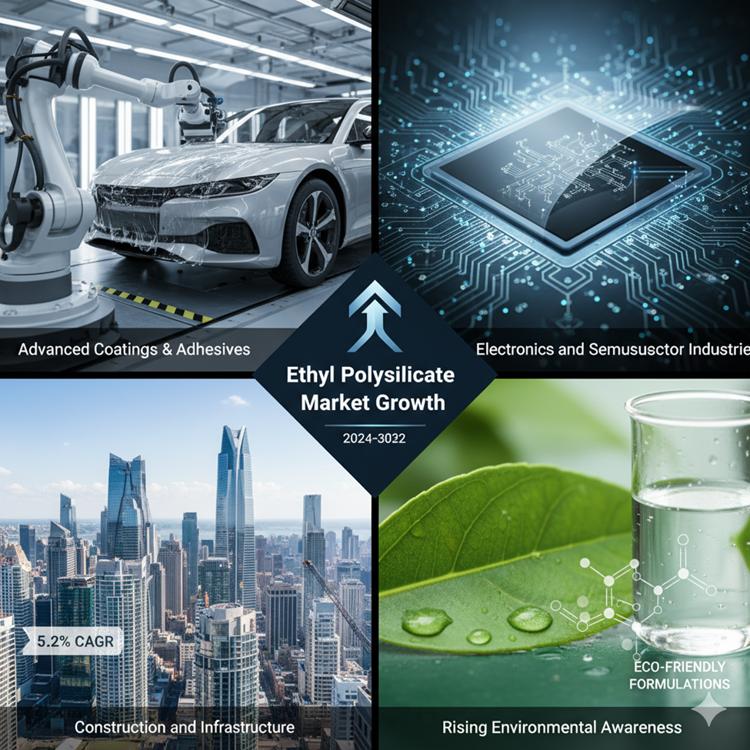

What Factors Are Fueling the Steady 5.2% CAGR in the Ethyl Polysilicate Market?

The ethyl polysilicate market has been witnessing consistent growth over the past few years. Valued at USD 134.5 million in 2024, it is projected to reach USD 201.8 million by 2032, expanding at a robust Compound Annual Growth Rate (CAGR) of 5.2%. But what are the driving forces behind this steady growth? Why is ethyl polysilicate increasingly becoming a material of choice across industries such as electronics, construction, and coatings? This article explores the key factors propelling the ethyl polysilicate market, regional trends, and opportunities for manufacturers to capitalize on this growth trajectory.

Understanding Ethyl Polysilicate

Ethyl polysilicate is a silicon-based compound widely used in coatings, sealants, adhesives, and various industrial applications. Its unique chemical structure imparts exceptional durability, chemical resistance, and thermal stability. These properties make it highly versatile in sectors requiring high-performance materials. The demand for ethyl polysilicate has expanded in recent years due to its ability to enhance the longevity and reliability of products across multiple industries.

Key Factors Driving the 5.2% CAGR

1. Rising Demand for Advanced Coatings, Sealants, and Adhesives

One of the primary growth drivers of the ethyl polysilicate market is the increasing demand for advanced coatings, sealants, and adhesives. Industries are constantly seeking materials that provide superior durability, resistance to harsh chemicals, and long-term performance. Ethyl polysilicate fits the bill perfectly, offering:

- Enhanced Durability: Its ability to resist degradation under extreme environmental conditions makes it ideal for protective coatings.

- Chemical Resistance: Industrial applications often require materials that can withstand exposure to solvents, acids, and other chemicals without losing structural integrity.

- Adhesion Strength: In adhesives, ethyl polysilicate ensures strong bonding across a variety of surfaces, including metals, glass, and concrete.

As sectors like automotive, aerospace, and industrial manufacturing continue to prioritize durability and reliability, the demand for ethyl polysilicate-based materials is expected to rise steadily.

2. Growth of the Electronics and Semiconductor Industries

The electronics and semiconductor sectors have emerged as significant contributors to the ethyl polysilicate market. The compound is widely used in:

- Insulating Coatings: It provides electrical insulation for delicate components, preventing short circuits and improving device longevity.

- Protective Coatings: Semiconductors and electronic circuits require protective layers to safeguard against moisture, dust, and thermal stress.

Rapid advancements in consumer electronics, data centers, and semiconductor fabrication are creating a sustained demand for high-performance insulating and protective materials. Countries like China, Japan, South Korea, and Taiwan are at the forefront of semiconductor manufacturing, further boosting regional demand for ethyl polysilicate.

3. Expanding Construction and Infrastructure Activities

Construction and infrastructure development are key drivers behind the adoption of ethyl polysilicate, particularly in coatings for concrete, glass, and metals. The compound enhances:

- Structural Protection: Ethyl polysilicate coatings protect concrete and steel from corrosion and environmental degradation.

- Aesthetic Appeal: Transparent coatings maintain the visual appeal of glass and metal surfaces while adding durability.

- Sustainability: Some ethyl polysilicate formulations contribute to eco-friendly construction practices by reducing the need for frequent repairs or replacement.

As urbanization accelerates globally, especially in Asia-Pacific, large-scale construction projects are increasing the consumption of ethyl polysilicate, driving market growth.

4. Rising Environmental Awareness and Demand for Eco-Friendly Formulations

Sustainability is an increasingly important consideration in material selection. Manufacturers are now developing environmentally friendly ethyl polysilicate formulations that minimize volatile organic compounds (VOCs) and reduce environmental impact. These innovations are opening new market opportunities:

- Regulatory Compliance: Governments are enforcing stricter environmental regulations, incentivizing the use of low-VOC coatings.

- Consumer Preference: Industries are responding to growing demand for sustainable products by adopting green materials.

- Innovation Opportunities: Eco-friendly formulations provide differentiation in a competitive market, allowing manufacturers to expand their market presence.

The convergence of environmental awareness, regulations, and sustainability initiatives is steadily contributing to the 5.2% CAGR.

5. Technological Advancements and Innovation

Innovation in product formulations and application methods is another key factor driving market growth. Leading companies are investing in research and development to enhance ethyl polysilicate performance. Recent advancements include:

- High-Temperature Stability: New formulations can withstand extreme temperatures, expanding applications in aerospace, electronics, and industrial manufacturing.

- Improved Coating Techniques: Innovations in spray, dip, and brush coating methods enhance efficiency and reduce material waste.

- Hybrid Materials: Combining ethyl polysilicate with other polymers improves mechanical strength and chemical resistance.

Technological progress not only drives demand but also enables the development of new applications that were previously unattainable, sustaining market growth over the forecast period.

Regional Insights: Where Growth Is Concentrated

Asia-Pacific: The Market Leader

Asia-Pacific holds a dominant position in the ethyl polysilicate market, accounting for approximately 46% of global share in 2024. This growth is fueled by:

- Rapid industrialization and urbanization.

- Expansion of the electronics and semiconductor industries in China, Japan, and South Korea.

- Large-scale infrastructure and construction projects.

The region’s favorable manufacturing ecosystem and high demand for protective and insulating materials make it a strategic hub for ethyl polysilicate consumption.

Europe: Innovation Through Regulation

Europe accounted for 28% of the market share in 2024. The region’s growth is largely driven by:

- Stringent regulatory standards in coatings and adhesives.

- High demand for premium, eco-friendly, and innovative materials.

- Technological adoption in construction and industrial applications.

European manufacturers are at the forefront of developing sustainable and high-performance formulations, boosting market demand.

North America: Steady Growth Through Industrial Demand

North America holds about 19% of the market. Growth in this region is supported by:

- Advanced construction and industrial activities.

- Adoption of sustainable building practices.

- Leadership in electronics manufacturing and semiconductor technology.

While growth is steady, the emphasis on quality, safety, and regulatory compliance ensures ongoing demand for ethyl polysilicate.

Emerging Markets: Latin America, Middle East & Africa

Emerging economies are presenting new opportunities due to:

- Infrastructure development projects.

- Growing industrialization and urban expansion.

- Increasing adoption of modern construction practices.

These regions may not yet match Asia-Pacific or Europe in market share, but they are poised to contribute significantly to long-term growth.

Competitive Landscape: Key Players Driving Market Growth

The ethyl polysilicate market is competitive, with leading players driving growth through innovation, expansion, and strategic partnerships. Companies focus on:

- Enhancing product performance.

- Developing eco-friendly formulations.

- Expanding regional reach, particularly in Asia-Pacific and emerging markets.

The competitive environment encourages continuous innovation, which further supports the market’s CAGR of 5.2%.

Opportunities for Manufacturers

Manufacturers can capitalize on the growing demand for ethyl polysilicate through several strategic approaches:

- Product Innovation: Developing high-performance and eco-friendly formulations.

- Geographical Expansion: Targeting high-growth regions like Asia-Pacific and emerging markets.

- Application Diversification: Exploring untapped applications in aerospace, automotive, and industrial machinery.

- Sustainability Leadership: Aligning products with global environmental regulations and sustainability trends.

By focusing on these opportunities, companies can strengthen their market presence and sustain growth over the forecast period.

How Ethyl Polysilicate Is Shaping Construction, Coatings, and High-Performance Industries

Ethyl polysilicate, a silicon-based compound, has emerged as a key material across multiple industrial sectors, from construction and coatings to electronics and semiconductors. Valued for its durability, chemical resistance, and versatility, it plays a critical role in enhancing product performance, longevity, and sustainability. With applications expanding into eco-friendly formulations and high-performance industrial uses, the market for ethyl polysilicate is on a steady growth trajectory. This article explores the driving factors, industry applications, market trends, and innovations fueling this growth.

Rising Use in Construction and Protective Coatings

One of the strongest drivers for ethyl polysilicate adoption is its role in construction applications, particularly in protective coatings for concrete, glass, and metals. The compound strengthens adhesion, improves surface durability, and enhances chemical resistance, making it an ideal choice for infrastructure projects exposed to harsh environmental conditions.

Increasing global urbanization and substantial investments in infrastructure are further fueling adoption. Governments and private developers alike are prioritizing materials that ensure long-term performance and reduced maintenance costs. Protective coatings using ethyl polysilicate not only extend the life of construction materials but also provide resistance to weathering, corrosion, and chemical exposure.

Industry Example:

WACKER® SILICATE TES 28, which contains approximately 28.5 wt.% SiO₂, serves as a liquid source of silica. Through thermal decomposition, it forms a thin, heat-resistant SiO₂ film on inorganic substrates like ceramic cores, significantly enhancing mechanical strength and chemical stability. This makes it particularly suitable for demanding construction and industrial applications where durability is critical.

Expanding Role in Paints, Sealants, and Adhesives

Ethyl polysilicate is increasingly recognized for its performance in the paints, sealants, and adhesives (PSA) sector. It functions as a cross-linking and binding agent, improving the stability, durability, and moisture resistance of coatings and adhesive formulations.

As industries demand higher-performing materials, manufacturers are leveraging ethyl polysilicate to produce products with extended lifecycles, reduced maintenance requirements, and resistance to environmental stressors. The compound’s versatility across formulations allows it to meet stringent industrial standards while supporting innovations in high-performance coatings.

Industry Example:

WACKER® Silicate TES 28 (tetraethyl orthosilicate) delivers approximately 28.5 wt.% SiO₂ upon hydrolysis, enhancing moisture resistance in zinc-rich primers. Such properties are crucial for protective paints used in industrial and commercial sectors, where prolonged exposure to moisture and environmental elements can compromise performance.

Increasing Adoption in Electronics and Semiconductor Industries

The electronics and semiconductor industries are key contributors to ethyl polysilicate demand. The compound provides insulating and protective coatings that safeguard sensitive components from thermal fluctuations, mechanical stress, and moisture. This ensures the reliability and stability of devices ranging from consumer electronics to high-performance semiconductors.

With electronics manufacturing expanding, particularly in Asia-Pacific markets such as China, Japan, and South Korea, ethyl polysilicate use in this sector is accelerating. The compound’s insulating properties make it a preferred choice for enhancing device performance while extending the operational lifespan of delicate components.

Industry Example:

Semiconductor fabrication often involves thin-film coatings derived from tetraethyl orthosilicate (TEOS), forming uniform silica layers that protect substrates and prevent electrical leakage, a critical factor in high-performance computing and electronics.

Innovation in Eco-Friendly and Advanced Formulations

Environmental sustainability has become a major focus in materials development, and the ethyl polysilicate market is no exception. Regulatory pressures and consumer demand are pushing manufacturers to develop eco-friendly, low-emission formulations that comply with strict safety and environmental standards.

Eco-conscious innovations allow companies to meet sustainability goals while maintaining high performance in coatings, adhesives, and protective layers. These advancements also enhance competitiveness, particularly in regions where environmental regulations are stringent, such as Europe and North America.

Industry Example:

Evonik’s implementation of sustainable packaging for AEROSIL® silica achieved a 25% CO₂ reduction per pallet for hydrophilic grades. This initiative reflects a broader industry trend toward eco-friendly solutions that reduce environmental impact without compromising the functional benefits of ethyl polysilicate-based products.

Market Trends Driving Growth

1. Growing Integration in High-Performance Industrial Applications

Ethyl polysilicate’s utility extends beyond construction and coatings to high-performance industrial applications in sectors such as automotive and aerospace. Its ability to withstand extreme temperatures, provide chemical resistance, and enhance mechanical strength makes it an essential component in advanced formulations.

In industrial applications, ethyl polysilicate is increasingly used in protective coatings for metals and glass, improving product lifespan under challenging environmental conditions. Its compatibility with modern industrial formulations supports innovation and strengthens adoption across multiple sectors.

Industry Example:

AkzoNobel’s Interpon Redox Plus epoxy primer, combined with Interpon D2525 polyester topcoat, demonstrated less than 1.5 mm average corrosion creep from the scribe after 720 hours of Neutral Salt Spray testing (ISO 9227:2017). This showcases the compound’s capability in providing long-term protection in harsh conditions.

2. Rising Focus on Sustainable and Eco-Friendly Product Development

Sustainability trends are influencing product development strategies across the ethyl polysilicate market. Manufacturers are adopting eco-friendly, low-emission formulations that meet environmental standards while delivering high performance.

This trend is not only regulatory-driven but also market-driven, as industrial buyers increasingly prefer materials that minimize ecological impact. By integrating sustainability into product development, companies can differentiate themselves and access new growth opportunities, particularly in emerging markets.

Industry Example:

In addition to packaging improvements, eco-friendly TEOS-based coatings reduce VOC emissions, helping industrial clients comply with environmental regulations while maintaining protective performance.

Key Market Drivers in Summary

Based on the current landscape, the following factors are primarily responsible for the robust growth of the ethyl polysilicate market:

- Construction Applications: Protective coatings for concrete, glass, and metals are driving adoption, especially with growing infrastructure and urbanization projects.

- Paints, Sealants, and Adhesives: The compound’s ability to enhance stability, adhesion, and moisture resistance ensures strong demand in industrial formulations.

- Electronics and Semiconductor Industries: Insulating and protective applications in high-performance electronics are fueling market growth.

- Eco-Friendly Formulations: Sustainable and low-emission products align with regulatory requirements and environmental goals.

- High-Performance Industrial Applications: Automotive, aerospace, and industrial sectors are integrating ethyl polysilicate into advanced coatings, adhesives, and sealants for enhanced durability and safety.

Regional Insights

- Asia-Pacific: Dominates due to rapid urbanization, large-scale infrastructure projects, and growth in electronics manufacturing.

- Europe: Growth is supported by stringent environmental regulations and high demand for premium coatings.

- North America: Steady adoption in construction, industrial, and electronics sectors, supported by sustainable building practices.

- Emerging Markets: Latin America, the Middle East, and Africa are poised to contribute to long-term growth, driven by infrastructure and industrial expansion.

Ethyl Polysilicate Market: Challenges, Opportunities, and Industry Insights

Ethyl polysilicate, a versatile silicon-based compound, is becoming a cornerstone in construction, electronics, coatings, and industrial applications. Its durability, chemical resistance, and multifunctional properties make it indispensable across multiple sectors. While the market shows strong growth, it faces certain challenges that influence production, pricing, and global adoption. This article breaks down the market dynamics, opportunities, segmentation, regional trends, and key players in a clear, list-based format for easy reference.

1. Market Challenges

1.1 Volatility in Raw Material Prices and Production Costs

- Dependence on feedstocks: Ethyl polysilicate production relies heavily on silica and alcohol-based raw materials.

- Price fluctuations: Global shifts in raw material prices and supply chain disruptions impact manufacturing costs.

- Profit margin pressure: Rising costs reduce pricing flexibility, affecting both large and small producers.

- Competitive pressures: Intense market competition limits the ability to pass increased costs to end users.

- Strategic need: Manufacturers must focus on cost optimization and strategic sourcing to maintain stability.

1.2 Stringent Environmental and Safety Regulations

- Health and environmental concerns: Strict rules govern the handling, storage, and transportation of ethyl polysilicate.

- Operational complexities: Compliance requires continuous investment in safe production and logistics processes.

- Regional regulatory differences: Varying standards create barriers to global trade and product standardization.

- Challenges for small producers: Smaller companies struggle to adapt to evolving regulations, limiting market presence.

- Impact on growth: Regulatory pressures can slow growth and create uncertainty in long-term planning.

2. Market Opportunities

2.1 Expanding Applications in Construction and Electronics

- Construction sector: Protective coatings, adhesives, and sealants benefit from ethyl polysilicate’s durability and chemical resistance.

- Smart and green buildings: Rising investments in high-performance materials support wider adoption.

- Electronics manufacturing: Insulation and protective coatings are essential for device reliability, particularly in semiconductors.

- Asia-Pacific growth: Increased semiconductor production strengthens demand in electronics applications.

2.2 Innovation in Sustainable and High-Value Formulations

- Eco-friendly solutions: Low-emission and sustainable formulations align with strict environmental standards.

- Advanced grades: New grades for aerospace, automotive, and specialty chemicals enhance performance.

- Emerging markets: Latin America and the Middle East offer growth potential through industrialization and infrastructure development.

- Product differentiation: Innovation allows manufacturers to compete on quality and sustainability, rather than just price.

3. Market Segmentation

3.1 By End-Use

- Construction: Dominates due to applications in coatings, adhesives, and sealants that improve durability.

- Automotive: Used in heat-resistant adhesives and coatings for vehicle components.

- Aerospace: High-performance protective coatings and adhesives for extreme conditions.

- Electronics: Insulation and protective layers for semiconductors and electronic devices.

- Industrial: Reliable bonding and cross-linking agents in industrial manufacturing.

Example: Nissan Titan maintenance schedules highlight industrial precision and reliability, reflecting similar standards for ethyl polysilicate usage in critical applications.

3.2 By Chemistry

- Ethyl Polysilicate 28: General-purpose, balancing performance and cost, suitable for paints, primers, and coatings.

- Ethyl Polysilicate 32: Specialty uses requiring improved strength and adhesion.

- Ethyl Polysilicate 40: High silica content for superior performance in coatings and adhesives.

Example: KONASIL® fumed silica from OCI Company Ltd. ensures stable viscosity, anti-sag, and anti-settling properties in industrial primers.

3.3 By Application

- Paints and Coatings: Leading segment due to construction and industrial protective surfaces.

- Adhesives and Sealants: Growth supported by automotive, aerospace, and electronics sectors.

- Cross-Linking Agents: Key for industrial bonding applications.

- Chemical Synthesis: Provides structural and chemical stability in reactions.

- Foundry Applications: Ensures precise bonding and performance under extreme conditions.

4. Regional Analysis

4.1 Asia-Pacific

- Market share: 46% in 2024, the largest regional segment.

- Drivers: Rapid urbanization, large infrastructure projects, expanding electronics manufacturing hubs.

- Opportunities: Government investments in industrial growth, green building practices, and semiconductor production.

- Growth potential: Asia-Pacific remains the hub for long-term market expansion due to infrastructure and electronics development.

4.2 Europe

- Market share: 28% in 2024.

- Drivers: Industrial and construction activity supported by stringent regulatory frameworks.

- Applications: Advanced coatings, adhesives, and sealants for automotive, aerospace, and industrial uses.

- Innovation: Strong R&D in eco-friendly formulations.

- Sustainability: Green building standards reinforce consistent demand despite compliance costs.

4.3 North America

- Market share: 19% in 2024.

- Drivers: Industrial applications, protective coatings, and infrastructure development.

- Applications: Durability and chemical resistance in high-value construction and industrial projects.

- Trends: Sustainable materials adoption drives innovation.

- Leading country: United States due to advanced construction projects and electronics manufacturing.

5. Key Players

The ethyl polysilicate market is highly competitive, with global and regional players driving innovation, expansion, and market penetration:

- Momentive Performance Materials, Inc.

- BASF SE

- Huntsman Corporation

- Mitsubishi Chemical Holdings Corporation

- ShinEtsu Chemical Co., Ltd.

- Asahi Kasei Corporation

- Mitsubishi Materials Corporation

- Ineos Oligomers

- 3M Company

- Adeka Corporation

- DowDuPont, Inc.

- Evonik Industries AG

- Saint-Gobain S.A.

- Tosoh Corporation

These companies focus on high-performance, sustainable, and eco-friendly formulations, supporting market growth through innovation and regional expansion.

6. Summary of Market Drivers, Challenges, and Opportunities

- Drivers: Rising use in construction, protective coatings, electronics insulation, and advanced industrial applications.

- Challenges: Volatility in raw material prices, production costs, and stringent environmental regulations.

- Opportunities: Expanding applications in construction and electronics, sustainable product innovation, and growth in emerging markets.

- Segmentation Focus: Construction dominates by end-use; Ethyl Polysilicate 40 is the highest-performing chemistry; paints and coatings lead by application.

- Regional Insights: Asia-Pacific leads, Europe benefits from regulations and sustainability focus, North America sees steady industrial-driven growth.

Source: https://www.credenceresearch.com/report/ethyl-polysilicate-market

Who Are the Key Players Driving the Ethyl Polysilicate Market, and What’s Shaping Competition in 2025?

The ethyl polysilicate market is experiencing robust growth, fueled by rising applications in construction, electronics, coatings, and industrial sectors. But behind the growth lies a highly competitive landscape dominated by global chemical companies. Who are the leaders? What strategies are driving their success? And how is the market evolving with innovations and regional expansion? This article explores these questions in depth.

Which Companies Are Leading the Ethyl Polysilicate Market?

The ethyl polysilicate market is characterized by strong competition among multinational chemical firms. Key players include:

- Momentive Performance Materials, Inc.

- BASF SE

- Huntsman Corporation

- Mitsubishi Chemical Holdings Corporation

- ShinEtsu Chemical Co., Ltd.

- Asahi Kasei Corporation

- Mitsubishi Materials Corporation

These companies focus on technological advancement, product innovation, and strategic partnerships to strengthen their market positions. By delivering high-performance grades tailored for construction, coatings, adhesives, and electronics, they maintain leadership in a highly consolidated market.

Question: How do these leading players differentiate themselves in a competitive market?

The answer lies in a combination of innovation, capacity expansion, and regional diversification. Continuous investments in eco-friendly and low-emission formulations allow companies to meet regulatory requirements while enhancing performance. Partnerships with end-use industries, such as automotive, aerospace, and electronics, help secure long-term demand.

What Recent Developments Are Shaping the Competitive Landscape?

Recent activities by major players reflect a dynamic market with strong growth potential:

- Momentive Performance Materials, Inc.: In April 2025, the company launched HARMONIE NatuVel gel, a 100% biobased elastomer gel, at in-cosmetics Global 2025 in Amsterdam. This launch highlights the growing emphasis on sustainable, eco-friendly products.

- BASF SE: In May 2025, BASF signed an agreement to acquire DOMO Chemicals’ 49% stake in the Alsachimie joint venture, giving it full ownership and control over production and strategic operations in key markets.

- Ineos Energy: Completed the acquisition of CNOOC Energy Holdings U.S.A. Inc. in April 2025, significantly expanding its U.S. Gulf energy assets and strengthening market presence.

Question: How do mergers, acquisitions, and new product launches influence market dynamics?

Strategic acquisitions and partnerships allow companies to expand regional reach, access new technologies, and consolidate market share. Product launches, particularly eco-friendly formulations, help players meet evolving regulatory standards and end-user preferences. Together, these strategies reinforce competitiveness while driving innovation across applications.

How Are Companies Competing Through Innovation?

Product innovation remains a central strategy in the ethyl polysilicate market. Companies are introducing specialized grades designed for diverse industrial applications:

- Construction and Infrastructure: High-performance coatings and sealants that improve durability and chemical resistance.

- Electronics and Semiconductors: Insulating and protective layers that ensure device reliability.

- Aerospace and Automotive: Advanced materials that meet high temperature, mechanical stress, and safety requirements.

Question: Why is innovation crucial for long-term success in this market?

Innovation enables companies to differentiate themselves, capture premium pricing, and respond to regulatory requirements. As end-use industries demand higher-performing and environmentally sustainable solutions, continuous R&D investment ensures that market leaders maintain technological advantage and relevance.

What Role Does Regional Expansion Play in Competitive Strategies?

Regional presence is a critical factor for success in the ethyl polysilicate market:

- Asia-Pacific: Dominates growth with industrial expansion, rising semiconductor production, and large-scale infrastructure projects. Companies invest heavily in this region to capitalize on urbanization trends and increasing construction demand.

- Latin America and Middle East: Opportunities arise from infrastructure development and industrialization, attracting strategic investments from global players.

- Europe and North America: Established markets with regulatory frameworks encourage innovation and sustainable product development.

Question: How does regional expansion affect competitiveness and market share?

Expanding into high-growth regions allows companies to increase sales, reduce reliance on mature markets, and access local expertise. It also provides a platform for partnerships with end-use industries, fostering long-term customer relationships and market stability.

What Are the Emerging Opportunities in the Ethyl Polysilicate Market?

Several factors create significant opportunities for players in the coming years:

- Protective Coatings for Construction and Infrastructure: Demand for durable, chemical-resistant coatings continues to rise.

- Electronics and Semiconductor Industries: Expansion in Asia-Pacific drives the need for insulating and protective layers.

- Eco-Friendly and Low-Emission Formulations: Regulatory compliance and sustainability trends favor innovation in greener products.

- High-Value Sectors: Aerospace and automotive industries are adopting advanced ethyl polysilicate grades.

- Emerging Markets: Latin America and the Middle East present growth potential through infrastructure and industrial projects.

Question: How can companies leverage these opportunities to gain a competitive edge?

By investing in R&D for specialized products, forming strategic partnerships, and targeting high-growth regions, companies can capture new market segments. Focused innovation in eco-friendly and high-performance solutions ensures alignment with global sustainability initiatives, creating long-term value for both manufacturers and customers.

What Challenges Could Impact Competition?

While opportunities are abundant, several challenges shape the competitive landscape:

- Regulatory Compliance: Stringent environmental and safety regulations require ongoing investments in production, handling, and logistics.

- Raw Material Volatility: Fluctuating prices for silica and alcohol-based feedstocks affect production costs and pricing strategies.

- Market Consolidation: Smaller companies may struggle to compete against multinational corporations with established technological capabilities and global reach.

Question: How do these challenges influence market strategies?

Leading players prioritize cost optimization, strategic sourcing, and technological advancement to mitigate risks. Regulatory compliance drives the development of safer, eco-friendly formulations, while smaller firms may seek niche applications or partnerships to remain competitive.

How Is Technology Shaping the Future of Competition?

Technological advancements continue to redefine the ethyl polysilicate market:

- High-Performance Grades: Specialized materials tailored for electronics, automotive, aerospace, and industrial applications.

- Sustainable Solutions: Low-emission and biobased formulations to meet global environmental standards.

- Process Efficiency: Innovations in production and application methods enhance quality, reduce waste, and lower costs.

Question: Why is technology a key differentiator in a consolidated market?

In a market dominated by a few multinational corporations, technological leadership provides a competitive advantage. Companies that continuously innovate can deliver superior performance, enter new applications, and respond proactively to regulatory and market changes.

Future Outlook: What Will Shape the Ethyl Polysilicate Market?

The ethyl polysilicate market is expected to maintain steady growth, driven by diverse end-use applications and regional expansion:

- Protective Coatings: Rising adoption in construction and infrastructure projects.

- Electronics: Strong demand for insulation and protective layers in semiconductors.

- Eco-Friendly Formulations: Continued focus on sustainable, low-emission products.

- High-Value Industries: Aerospace and automotive applications will drive specialized product demand.

- Asia-Pacific Expansion: Industrial growth and semiconductor production will remain key growth drivers.

- Emerging Markets: Infrastructure investments in Latin America and the Middle East will create new opportunities.

- Product Innovation: Specialized grades will reinforce competitiveness.

- Regulatory Compliance: Challenges will also promote safer, advanced product development.

Question: How can manufacturers position themselves for success in the next decade?

Companies should invest in innovation, sustainability, and regional expansion while strengthening partnerships with end-use industries. By addressing regulatory requirements and technological advancements, manufacturers can secure long-term growth and maintain leadership in a competitive and evolving market.

Conclusion: The ethyl polysilicate market is poised for significant growth, with projections indicating an increase from USD 134.5 million in 2024 to USD 201.8 million by 2032, reflecting a compound annual growth rate (CAGR) of 5.2% . This expansion is primarily driven by the escalating demand for advanced coatings, adhesives, and sealants that offer enhanced durability and chemical resistance. The electronics and semiconductor industries further contribute to this growth due to the compound’s application in insulating and protective coatings. Additionally, the construction sector's increasing adoption of ethyl polysilicate in protective coatings for concrete and glass is shaping a positive outlook. The rising environmental awareness is encouraging the development of eco-friendly formulations, providing manufacturers with opportunities to innovate and strengthen their market presence.

Regionally, Asia-Pacific leads the ethyl polysilicate market, accounting for 46% of the market share in 2024. This dominance is attributed to large-scale construction activities, industrial growth, and increasing demand from electronics manufacturing in countries like China, Japan, and South Korea. Europe follows, supported by stringent standards in paints and coatings, while North America maintains steady growth through its advanced construction and industrial sectors. Emerging economies in Latin America and the Middle East & Africa are expected to present new opportunities driven by infrastructure development projects.

In conclusion, the ethyl polysilicate market is on a robust growth trajectory, underpinned by its critical role in various industrial applications, ongoing product innovation, and alignment with global sustainability trends. This positions the market well for sustained demand and potential investment opportunities in the coming years.

Source: https://www.credenceresearch.com/report/ethyl-polysilicate-market