-

Web sayfası bildirimcisi

- EXPLORE

-

Blogs

Canada Wind Energy Market 2026 Size, Share, Industry Overview and Forecast to 2034

IMARC Group has recently released a new research study titled “Canada Wind Energy Market Size, Share, Trends and Forecast by Component, Rating, Installation, Turbine Type, Application, and Region, 2026-2034”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Canada Wind Energy Market Overview

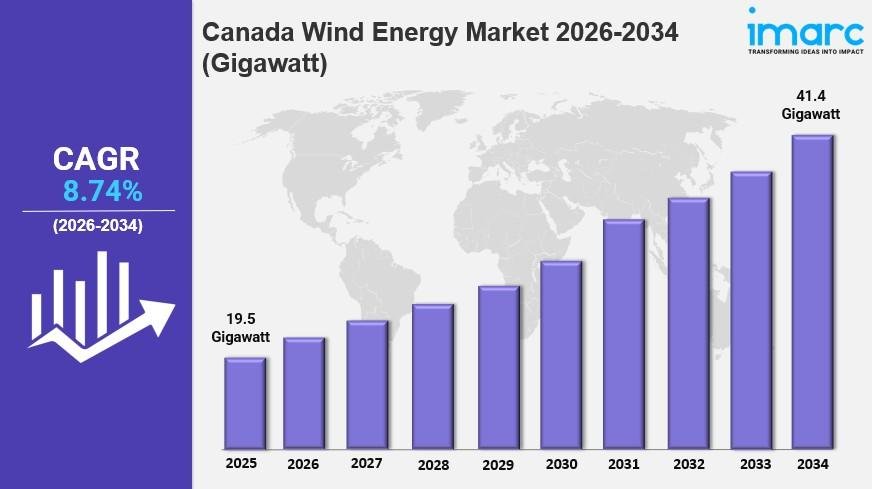

The Canada wind energy market size reached 19.5 Gigawatt in 2025, and it is expected to grow to 41.4 Gigawatt by 2034. The market is forecasted to expand at a CAGR of 8.74% during the 2026-2034 period. Growth is fueled by increased investment in onshore and offshore projects, technological advancements in turbines, and supportive government policies promoting clean energy adoption. Cross-border electricity trade also strengthens market reach and helps accelerate renewable energy integration across sectors.

Study Assumption Years

● Base Year: 2025

● Historical Year/Period: 2020-2025

● Forecast Year/Period: 2026-2034

Canada Wind Energy Market Key Takeaways

● Current Market Size: 19.5 Gigawatt in 2025

● CAGR: 8.74%

● Forecast Period: 2026-2034

● Advancements in turbine technology including larger rotor diameters and cold-weather adaptations enhance energy capture and reliability.

● Government policies such as Bill C-49 and Ontario's Feed-in Tariff support offshore and onshore wind development.

● Canada's vast and consistent wind resources provide economic feasibility for wind power expansion.

● Increasing corporate adoption of wind through power purchase agreements (PPAs) stabilizes market demand.

● Integration of cross-border electricity trade with the U.S. diversifies revenue streams and supports large-scale projects.

Sample Request Link: https://www.imarcgroup.com/canada-wind-energy-market/requestsample

Canada Wind Energy Market Growth Factors

The Canada wind energy market is strongly supported by favorable government policies and incentive programs that promote renewable energy adoption and lower carbon emissions, contributing to the expansion of Canada wind energy market share. For example, Bill C-49 received Royal Assent in October 2024, permitting offshore wind projects in Atlantic Canada with a 5 GW power production target. Additionally, the government’s carbon pricing plan obliges industries to lower emissions or pay a carbon tax, motivating a transition toward wind power. Provincial programs like Ontario’s Feed-in Tariff (FIT) guarantee long-term contracts at favorable rates, stimulating investment stability and project financing.

The abundance of wind resources across Canada is a critical growth factor. In 2022, wind energy generated 36 terawatt-hours, accounting for 5.7% of total electricity and powering around three million homes. The large expanses of unused or underutilized land, especially in rural and remote areas, provide flexibility for developers to implement multiple projects simultaneously. The nation’s supportive infrastructure and access to transmission networks collectively enhance the economic feasibility and scalability of wind power development.

Increasing demand for clean energy fuels market growth, driven by heightened awareness of climate change and corporate commitments to renewable energy targets through power purchase agreements (PPAs). In December 2024, Canada extended its net-zero electricity grid target to 2050 under the Clean Electricity Regulations, aiming to cut 181 million tonnes of carbon emissions by relying on wind and hydropower. This regulatory focus, coupled with growing consumer support and incorporation of renewables in the energy mix, accelerates wind energy adoption nationwide.

To get more information on this market: Request Sample

Canada Wind Energy Market Segmentation

Analysis by Component:

● Turbine: Directly influences power output and efficiency; growing investments in advanced technology optimize energy capture even at low wind speeds.

● Support Structure: Durable foundations and corrosion-resistant designs support diverse terrains and offshore environments, ensuring long-term stability.

● Electrical Infrastructure: Modern substations, transformers, and smart grids enable efficient power transmission and integration into the national grid.

● Others

Analysis by Rating:

- ≤ 2 MW

- >2 ≤ 5 MW

- >5 ≤ 8 MW

- >8 ≤ 10 MW

- >10 ≤ 12 MW

- >12 MW

Analysis by Installation:

● Offshore: Emerging driver with strong Atlantic wind resources; supported by government exploration and international collaboration.

● Onshore: Backbone of the market with abundant land, lower costs, and faster deployment, dominates installed capacity.

Analysis by Turbine Type:

● Horizontal Axis: Widely preferred for efficiency and large-scale projects; supported by continuous technological advancements.

● Vertical Axis: Compact, suitable for urban, small-scale, and distributed energy systems, growing in niche applications.

Analysis by Application:

● Utility: Extensively supported by government and utility investments for large-scale grid power generation.

● Industrial: Increasing adoption by sectors aiming to reduce costs and carbon footprints through captive projects or PPAs.

● Commercial: Growing use in businesses prioritizing sustainability, supported by incentives and certifications.

● Residential

Regional Insights

Ontario is the dominant region in Canada’s wind energy market, attributed to its strong policy framework, renewable energy incentives, and large wind potential in areas like southwestern Ontario. Continuous investments in transmission infrastructure enable seamless grid integration, attracting domestic and international developers. Technological advancements and partnerships with private investors bolster project execution and financing, making Ontario a key contributor to the country’s wind energy growth.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=29947&flag=C

Recent Developments & News

In August 2025, Canada designated four offshore wind areas off Nova Scotia to support a 5 GW licensing goal by 2030, aiming to establish Nova Scotia as a clean energy leader. London-based Atlantica Sustainable Infrastructure acquired Statkraft's Canadian renewable platform, adding 236 MW operational capacity and a 0.8 GW pipeline. In June 2025, Vestas secured a 124 MW turbine order for Quebec's Haute-Chaudiere project, including a 10-year service agreement. The Canada Infrastructure Bank invested CAD 108.3 million in the 102.2 MW MU2 wind farm in Quebec, expected to start operations in late 2026. In January 2025, Nordex Group secured 247 MW in Nova Scotia orders, expanding North American sales by 350% in 2024.

Key Players

● Atlantica Sustainable Infrastructure

● Statkraft

● Vestas

● EDF Power Solutions

● Marmen

● Canada Infrastructure Bank

● Innergex

● Nordex Group

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302