Hydrogen Energy Storage Market 2025: Size, Share, In-Depth Analysis and Forecast to 2033

IMARC Group, a leading market research company, has recently released a report titled "Hydrogen Energy Storage Market Size, Share, Trends and Forecast by Product Type, Technology, Application, End User, and Region, 2025-2033." The study provides a detailed analysis of the industry, including the global hydrogen energy storage market forecast, size, trends, growth and share. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Hydrogen Energy Storage Market Overview:

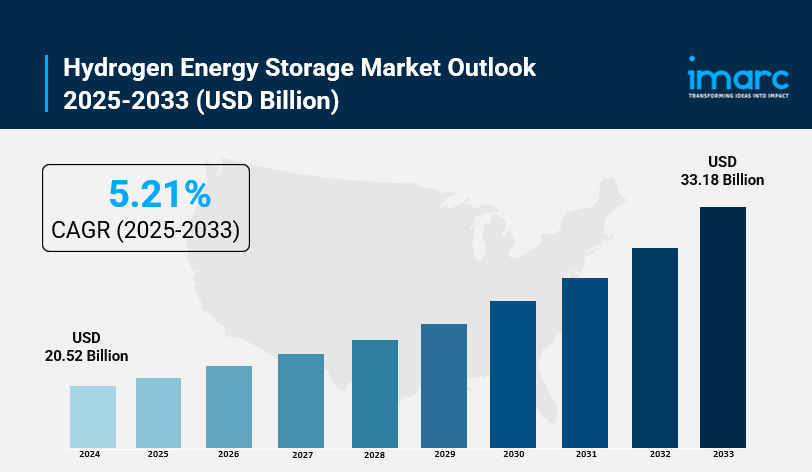

The global hydrogen energy storage market was valued at USD 20.52 Billion in 2024 and is expected to reach USD 33.18 Billion by 2033. The market is projected to grow at a CAGR of 5.21% during the forecast period of 2025-2033. Increasing integration of renewable energy sources like solar and wind, along with supportive government policies and technological advancements in hydrogen storage, are driving the market’s expansion.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Hydrogen Energy Storage Market Key Takeaways

- The global hydrogen energy storage market size was USD 20.52 Billion in 2024.

- The market is expected to grow at a CAGR of 5.21% from 2025 to 2033.

- The forecast period of the study is from 2025 to 2033.

- Asia Pacific dominated the market in 2024 with a 37.58% market share, led by countries like Japan, South Korea, China, and India.

- Technological advancements including improvements in electrolysis and hydrogen storage methods (compressed gas, metal hydrides, and liquid hydrogen) are continuously enhancing efficiency and lowering costs.

- Governments worldwide, including the US, UK, Europe, and Asia, actively support hydrogen energy storage growth through funding, policies, and incentives.

- The transportation sector is a major application area, driven by demand for hydrogen fuel cell vehicles.

Request Your Free “Hydrogen Energy Storage Market” Insights Sample PDF: https://www.imarcgroup.com/hydrogen-energy-storage-market/requestsample

Market Growth Factors

Increased interest in the hydrogen energy storage industry is driven by the transition towards intermittent renewable energy generation such as solar or wind. Hydrogen energy stores energy. It can store excess energy that generators produce in periods that have high production. The stored energy may be for use later during periods of low energy production. Businesses and governments labor to develop hydrogen from renewable energy for long-duration storage to manage the variability of renewables and avoid fossil fuel use. This hydrogen storage can decarbonize industry, transportation, and power sectors regarding emissions. Fuel cell or combustion engine-based transportation uses low-cost, clean hydrogen as a replacement fuel.

Governments around the globe support hydrogen storage technologies. Governments implement policies. Governments provide subsidies. Governments fund programs. Governments offer tax incentives. These actions ease research. These actions ease development. These actions ease infrastructure development. These actions drive market growth. In the U.S. from 2022 through 2025, USD 338 billion of federal investments have been made in order to drive energy technologies. In Europe and in Asia regulations and green energy subsidies are focused on accelerating the use of hydrogen as a scalable fossil fuel alternative. In the 2024 UK budget, £2 billion was allocated toward hydrogen projects within a key aspect of a clean energy strategy. This seeks to reduce the barriers toward entry and the capital cost during developing infrastructure, including hydrogen refueling stations and hydrogen transport networks.

Research drives improvements in hydrogen storage that affect efficiency, capacity, and affordability using electrolysis, compressed hydrogen gas, liquid hydrogen, and metal hydride methods that improve energy conservation and energy density. Hydrogen energy systems rival conventional energy storage, such as batteries, for long-duration applications because novel materials with nanotechnologies increase energy efficiency and lower storage costs with examples such as high-performance proton exchange membranes under development in Korea. As a result, hydrogen storage is increasing in use for energy generation, including transport and industrial applications, with improved safety, scalability and efficiency.

Market Segmentation

Breakup By Product Type:

- Liquid

- Solid

- Gas: The largest segment in 2024 storing hydrogen in gaseous state at high pressures (up to 700 bar). Widely used in fuel cell vehicles and industrial hydrogen supply, offering cost-effectiveness and simplicity with low infrastructure demands.

Breakup By Technology:

- Compression: Holds 42.2% market share in 2024; densifies hydrogen gas between 200-700 bar in special tanks. Favored for its scalability and cost efficiency across transportation and industrial sectors.

- Liquefaction

- Material Based

Breakup By Application:

- Stationary Power

- Transportation: Leading application in 2024, driven by demand for zero-emission hydrogen fuel cell vehicles including cars, buses, trucks, and trains offering long ranges and fast refueling.

Breakup By End User:

- Industrial: Largest end-user in 2024 with 47.8% market share. Uses include manufacturing, chemical production, refining, and heavy industry processes requiring high heat, substituting fossil fuels to reduce emissions.

- Commercial

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific dominates the hydrogen energy storage market with a 37.58% share in 2024. Key countries such as Japan, South Korea, China, and India are investing heavily in hydrogen infrastructure and renewable integration driven by policies to reduce carbon emissions. Japan leads in hydrogen refueling infrastructure, while China focuses on scaling hydrogen production and storage. The region’s growing energy demand and focus on sustainable energy markets position it as the largest and fastest-growing regional market.

Recent Developments & News

- April 2025: Energy Vault secured USD 28 million in financing for the Calistoga Resiliency Center, integrating hydrogen energy storage with infrastructure resilience.

- April 2025: Asian Development Bank approved USD 104 million loan for Georgia’s first energy storage facility, combining battery and hydrogen systems.

- April 2025: Energy Vault signed a 10-year deal with India’s SPML Infra to produce over 30 GWh of B-Vault battery systems, including hydrogen storage integration.

- January 2025: EQUANS and INOCEL partnered to develop scalable hydrogen energy storage solutions for ports, smart grids, and data centers.

Key Players

- Air Liquide

- Air Products and Chemicals, Inc.

- Chart Industries

- Engie

- Gravitricity

- Hexagon Purus

- ITM Power plc

- Linde PLC

- McPhy Energy S.A.

- Plug Power Inc.

- Pragma Industries

- Steelhead Composites, Inc.

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=4932&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302