-

أخر الأخبار

- استكشف

-

المدونات

Find Affordable Loans Fast with SuperMoney Loans

In today’s world, borrowing money has become a necessity for many people. Whether it’s to consolidate debt, cover unexpected expenses, finance education, or purchase a vehicle, loans can provide the financial flexibility needed to achieve important goals. But with so many lenders offering different interest rates, fees, and terms, finding the right loan can feel overwhelming.

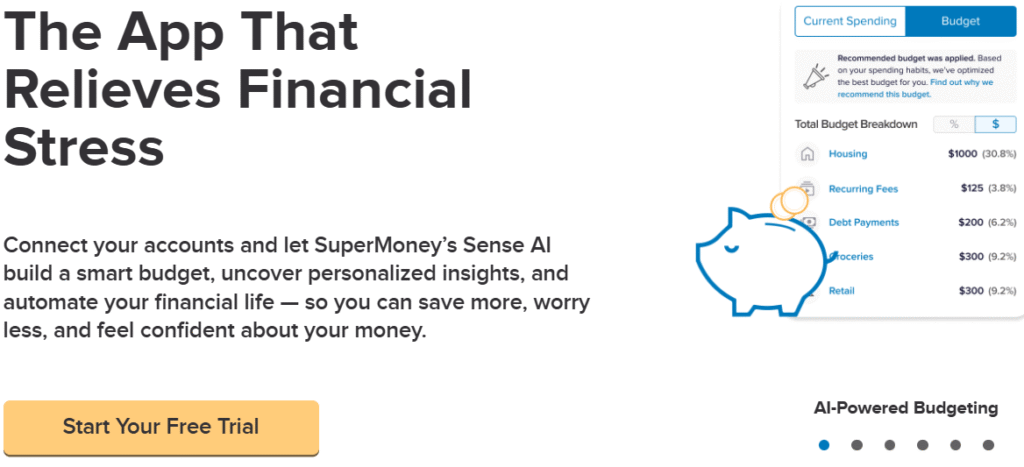

That’s where SuperMoney Loans makes a difference. As an online loan comparison platform, SuperMoney helps borrowers quickly find affordable loan options from multiple lenders, all in one place. With a fast, transparent, and credit-safe process, SuperMoney ensures that you don’t waste time or money while searching for the right loan.

In this article, we’ll explore how SuperMoney works, why it’s a reliable solution for today’s borrowers, and how it can help you secure affordable loans—fast.

Why Loan Comparison Matters

Not all loans are created equal. Two lenders offering the same loan amount may present drastically different terms. One might have a higher interest rate, while another may charge additional fees or offer stricter repayment terms.

Even a small difference in interest can lead to big savings. For example, a $10,000 loan with a 7% rate compared to a 9% rate could save you hundreds of dollars over the loan’s duration. By comparing loans before committing, you maximize your chances of finding the most affordable option.

SuperMoney Loans: How It Works

SuperMoney is not a lender—it’s a financial comparison marketplace. Its goal is to connect borrowers with reputable lenders while ensuring full transparency. Instead of filling out multiple applications with different lenders, you only need to provide your information once.

Here’s how SuperMoney simplifies borrowing:

-

Submit Your Details – Provide basic information like income, credit score range, loan purpose, and desired loan amount.

-

View Loan Offers – Instantly receive personalized loan options from multiple lenders.

-

Compare Side by Side – Review key details such as interest rates, fees, repayment terms, and monthly payments.

-

Select Your Loan – Choose the option that offers the best value for your needs.

-

Apply Securely – Finalize your application directly with the lender.

This process takes only minutes, saving borrowers hours of research and negotiation.

Key Benefits of Using SuperMoney Loans

1. Fast Results

SuperMoney provides instant loan comparisons, helping you find affordable loans in minutes instead of days.

2. Affordable Rates

By showcasing multiple lenders, SuperMoney encourages competition. This ensures borrowers see the most competitive and affordable rates available.

3. Credit-Safe Comparisons

SuperMoney uses soft credit checks, meaning you can explore loan options without negatively impacting your credit score.

4. Transparency

All fees, interest rates, and repayment terms are displayed upfront, eliminating surprises or hidden costs.

5. Wide Loan Selection

From personal loans and auto financing to student loans and mortgages, SuperMoney caters to a wide range of borrowing needs.

Loan Categories Available

SuperMoney Loans covers many common borrowing needs, including:

-

Personal Loans – Ideal for debt consolidation, medical bills, or large purchases.

-

Auto Loans – Financing for both new and used cars.

-

Student Loans & Refinancing – Solutions for funding education or restructuring existing debt.

-

Home Loans – Mortgage and refinancing options for homebuyers and homeowners.

-

Business Loans – Tailored financing for small businesses and entrepreneurs.

With such variety, borrowers can address nearly any financial goal using one platform.

Why SuperMoney is the Smart Choice

Borrowers today demand speed, clarity, and affordability. SuperMoney delivers on all three by combining modern technology with an unbiased marketplace. Unlike lender websites that showcase only their own offers, SuperMoney presents a broader view—giving you the power to choose the best deal.

For anyone who values time, money, and financial confidence, SuperMoney is the smarter way to borrow.

Final Thoughts

Finding an affordable loan doesn’t have to be stressful. With SuperMoney Loans, you can compare multiple offers in minutes, identify the lowest rates, and borrow with confidence—all without risking your credit score.

Whether you’re consolidating debt, financing education, purchasing a vehicle, or funding a business, SuperMoney ensures that you secure the most affordable option quickly and easily. Instead of settling for the first loan offer you see, use SuperMoney to borrow smarter and save more.

Start your journey today and discover how simple it can be to find affordable loans fast with SuperMoney Loans.