-

Новости

- ИССЛЕДОВАТЬ

-

Статьи пользователей

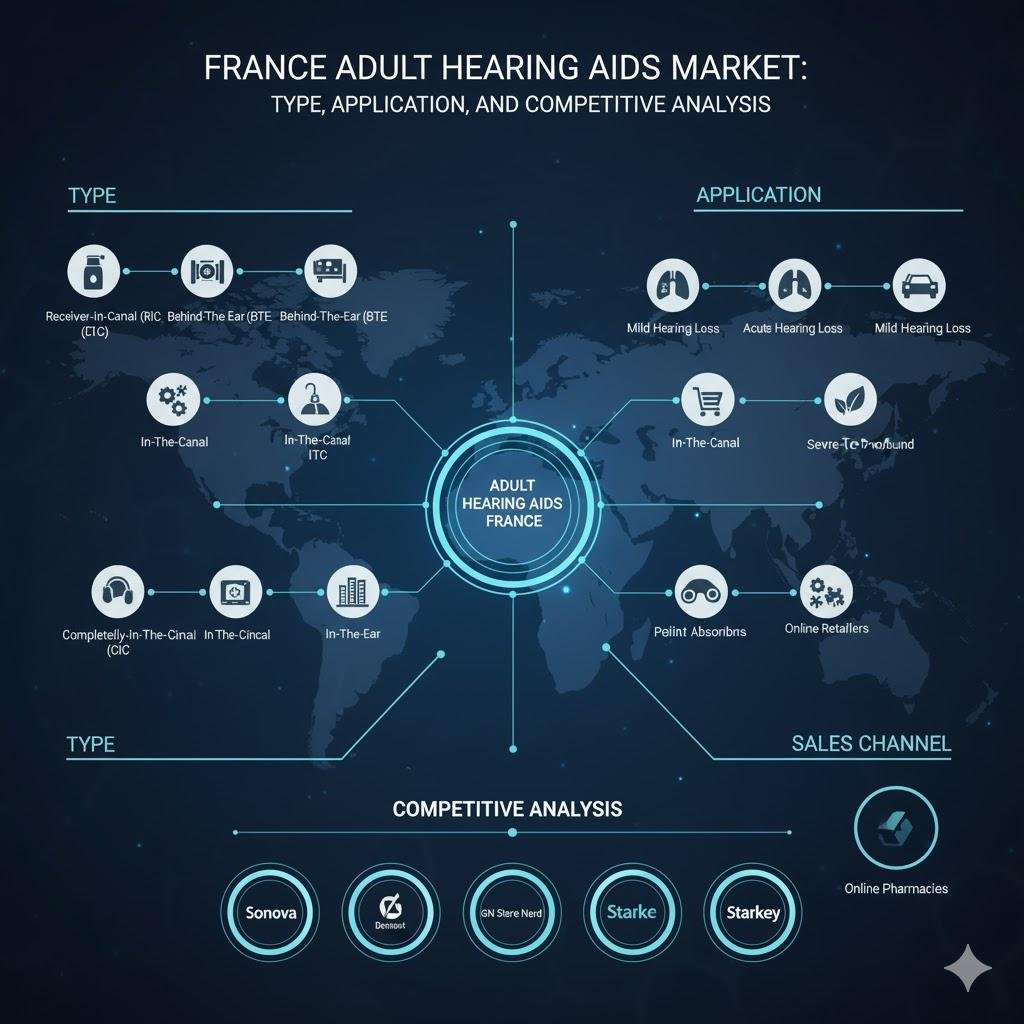

France Adult Hearing Aids Market: Type, Application, Sales Channel, and Competitive Analysis, 2024–2032

The adult hearing aids market in France is a dynamic and critical segment of the country's healthcare landscape, focused on addressing hearing loss a prevalent condition linked to aging, noise exposure, and genetic factors. France boasts a robust, state-supported healthcare system, which significantly influences the market's structure, accessibility, and consumer behaviour. The market is characterized by technological innovation, evolving regulatory frameworks, and a growing emphasis on patient-centric care.

According to Credence Research the France Adult Hearing Aids Market size was valued at USD 277.77 million in 2018 to USD 344.22 million in 2024 and is anticipated to reach USD 533.72 million by 2032, at a CAGR of 5.70% during the forecast period.

Source: https://www.credenceresearch.com/report/france-adult-hearing-aids-market

Market Overview & Forecast (2024–2032)

- Market Size & Growth Rate: The France adult hearing aids market was valued at approximately USD 350-400 million in 2023 and is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% to 7.0% during the forecast period. This would see the market reach an estimated value of USD 550-650 million by 2032.

- Key Growth Drivers:

- Aging Demographics: France has a rapidly aging population, with a significant proportion of citizens over 65, who are the primary users of hearing aids. This demographic shift is the most powerful long-term driver.

- Technological Advancement: The continuous innovation in features like Bluetooth connectivity, rechargeability, artificial intelligence (AI) for sound optimization, and telehealth capabilities is driving upgrades and attracting new users.

- Growing Awareness and Destigmatization: Public health campaigns and reduced stigma around hearing loss are encouraging more adults to seek diagnosis and treatment.

- Favorable Reimbursement System: The French national health insurance (l'Assurance Maladie) provides substantial reimbursement for hearing aids for eligible individuals, improving affordability and access.

- Key Restraints:

- High Out-of-Pocket Costs: Despite reimbursement, the cost of advanced hearing aids can still be significant, acting as a barrier for some segments of the population.

- Low Adoption Rate: A significant "treatment gap" persists, where many people with diagnosed hearing loss delay purchasing a device for several years.

- Regulatory Complexity: The "100% Health" (100% Santé) reform, while increasing accessibility, has created a two-tier market and compressed margins on certain devices, impacting traditional pricing strategies.

- Consumer Confusion: The variety of products, features, and sales channels can be overwhelming for consumers, potentially delaying the purchase decision.

Market Segmentation Analysis

a) By Type

This segmentation is based on the physical design and placement of the hearing aid.

- Behind-the-Ear (BTE):

- Description: The casing rests behind the ear, connected to an earmold inside the ear canal by a clear tube. Includes traditional BTE and the more discreet Receiver-in-Canal (RIC/RITE) styles.

- Market Share & Growth: Dominates the French market in terms of volume and revenue. RIC devices are particularly popular due to their discretion, comfort, and performance, especially for mild to severe hearing loss.

- In-the-Ear (ITE):

- Description: Custom-made devices that fit entirely within the outer ear bowl. This category includes Full Shell, Half Shell, and In-the-Canal (ITC) models.

- Market Share: Holds a smaller, stable share. Preferred by users who want a custom fit and dislike having a component behind the ear, but are less suitable for profound hearing loss.

- Completely-in-Canal (CIC) & Invisible-in-Canal (IIC):

- Description: The smallest and most discreet hearing aids, fitting deep within the ear canal.

- Market Share: A niche but important segment. Growth is driven by cosmetic appeal, though they are often more expensive and may have fewer features due to size constraints.

b) By Application

This refers to the degree of hearing loss the device is designed to address.

- Mild to Moderate Hearing Loss: The largest application segment. This group represents the majority of new users and is the primary target for entry-level and mid-range devices, including those covered under the "100% Health" reform.

- Severe to Profound Hearing Loss: A smaller but critical segment. These users require more powerful, feature-rich devices (typically high-end BTE or RIC models) to effectively manage their hearing loss.

c) By Sales Channel

This is a crucial segmentation in France, heavily influenced by the regulatory environment.

- Audiology Clinics & Hospitals (B2C):

- Description: The traditional and dominant sales channel. This involves a medical pathway: an ENT (Otolaryngologist) diagnosis followed by a fitting by a certified audiologist.

- Market Share: Holds the largest revenue share. This channel is characterized by a high-touch, professional service model including diagnosis, fitting, fine-tuning, and after-sales care. It is the primary channel for complex hearing loss cases and premium devices.

- Retail/Online Channels (DTC):

- Description: Includes online sales of hearing aids, as well as over-the-counter (OTC) and personal sound amplification products (PSAPs).

- Market Share & Growth: The fastest-growing segment. Driven by the global trend towards self-fitting solutions and the entry of new players. While currently a smaller part of the market, it is expanding rapidly by targeting the large, underserved population with mild-to-moderate hearing loss who are price-sensitive and value convenience.

- The "100% Health" Reform Impact: This 2021 policy created a dedicated channel for fully reimbursed ("zero out-of-pocket") hearing aids. Patients can obtain these specific, mid-tier devices through participating audiologists, which has consolidated volume in the professional channel for this product tier.

Competitive Landscape Analysis

The French market is highly competitive, featuring a mix of global giants and specialized distributors. The "100% Health" reform has intensified competition on price and value.

Key Players and Strategic Initiatives:

1. Demant Group (Oticon, Bernafon): A leading player with a strong brand reputation and a wide network of partner audiologists. Heavily invests in AI and connectivity technologies (e.g., Oticon Real).

2. WS Audiology (Widex, Signia): Formed from the merger of Widex and Sivantos, this entity holds significant market share with strong brands like Widex (known for sound quality) and Signia (known for technology innovation, e.g., Augmented Focus).

3. Sonova Group (Phonak, Unitron): A global leader with a comprehensive portfolio. Phonak is particularly strong in connectivity (Roger technology) and rechargeability, appealing to active, tech-savvy users.

4. GN Store Nord (ReSound): Known for its leadership in direct smartphone connectivity and geo-tagging features for automatic soundscape adjustment.

5. Starkey Hearing Technologies: A major global player focusing on integrated health features (e.g., fall detection, health tracking) and custom-fit solutions.

Key Competitive Strategies:

- Product Innovation & Differentiation: Continuous focus on developing unique features such as AI-driven sound processing, advanced tinnitus management, and seamless connectivity to iOS/Android ecosystems.

- Strategic Focus on the "100% Santé" Tier: All major players have developed specific product lines to qualify for the full reimbursement scheme, making this a key volume battleground.

- Strengthening Audiologist Partnerships: Despite the growth of DTC, the audiologist channel remains critical. Companies invest heavily in training, co-marketing, and providing fitting software and tools to secure loyalty.

- Exploring Hybrid and DTC Models: Some traditional manufacturers are cautiously exploring online assessment tools and direct consumer engagement to capture a share of the growing DTC segment without alienating their professional partners.

- Emphasis on Branding and Consumer Marketing: Increasing direct-to-consumer advertising to build brand awareness and drive demand, steering patients towards specific brands at the audiologist.

Regional Analysis

- Île-de-France (Paris Region):

- Market Position: The largest and most concentrated market.

- Characteristics: High population density, higher average disposable income, and the highest concentration of specialized audiology clinics and ENTs. Demand is strong for premium, feature-rich devices.

- Auvergne-Rhône-Alpes & Provence-Alpes-Côte d'Azur:

- Market Position: Major secondary markets.

- Characteristics: Significant aging populations in both urban and rural areas within these regions, driving consistent demand. A mix of urban clinics and broader distribution networks serves these areas.

- Other Regions (Nouvelle-Aquitaine, Occitanie, Grand Est):

- Market Position: Steady, volume-driven markets.

- Characteristics: These regions often have a higher proportion of elderly residents. The "100% Health" reform has a particularly strong impact here, improving access in areas where cost was a primary barrier. The focus is often on reliable, cost-effective solutions.

Conclusion

The France Adult Hearing Aids market from 2024 to 2032 is poised for steady, technology-driven growth, shaped by its unique regulatory landscape and demographic trends. The market is bifurcating into a volume-driven, reimbursement-led segment (due to "100% Health") and a premium, feature-driven segment. Success for manufacturers will depend on their ability to navigate this dual-track market: offering compelling, cost-effective solutions for the reimbursed tier while simultaneously innovating with advanced, connected features to capture the high-end, private-pay segment. The audiologist will remain the cornerstone of the market, but the rise of retail and online channels will force all players to adapt their strategies to meet evolving consumer expectations for accessibility, convenience, and transparency.

Source: https://www.credenceresearch.com/report/france-adult-hearing-aids-market