-

Ροή Δημοσιεύσεων

- ΑΝΑΚΆΛΥΨΕ

-

Blogs

Vulnerability Management Market Dynamics: Growth Forecast and Competitive Insights

Market Overview

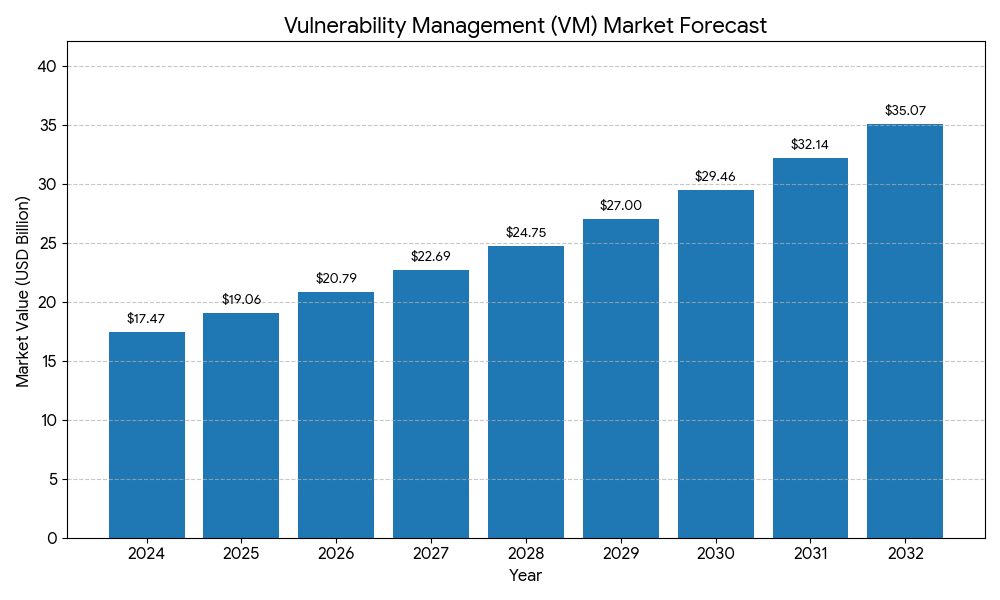

The Vulnerability Management (VM) Market was valued at USD 17.47 billion in 2024 and is forecast to reach USD 35.07 billion by 2032, reflecting a CAGR of 9.1%, as per Credence Research. Rising ransomware, zero-day exploits, and stricter compliance push enterprises to adopt continuous vulnerability scanning, risk-based prioritization, and automated remediation. Cloud and hybrid IT adoption expand attack surfaces, prompting vendors to deliver scalable, cloud-native platforms that integrate AI for predictive analytics and faster patch cycles. Demand from BFSI, healthcare, and IT sectors supports sustained growth and product innovation.

Source: https://www.credenceresearch.com/report/vulnerability-management-market

Market Drivers

Growing threat landscape and regulatory pressure

The Vulnerability Management (VM) Market expands because cyberattacks increase in frequency and complexity. Organizations require continuous scanning, real-time visibility, and prioritized remediation to protect critical assets. Stronger regulation and audit demands raise procurement urgency for compliance-ready platforms. Vendors answer with automated workflows and reporting that reduce manual effort and demonstrate governance. Investment in detection and patch orchestration rises across large enterprises and SMEs seeking risk reduction.

Cloud adoption and technology advancement fueling demand

Rapid cloud migration and reliance on containerized workloads create demand for scalable, cloud-native vulnerability solutions. It forces security teams to secure dynamic assets and distributed environments across multi-cloud estates. AI and automation shorten detection-to-remediation timelines and enable risk-based prioritization. Vendors that integrate with DevOps pipelines win faster adoption in development and operations teams. Cost pressures drive managed and SaaS offerings for smaller firms.

Market Trends and Opportunities

Shift to continuous and cloud-native solutions

The Vulnerability Management (VM) Market moves from periodic scans to continuous monitoring and real-time assessment. Cloud-native platforms integrate with DevOps and container ecosystems to close visibility gaps across hybrid architectures. It supports automated remediation and live dashboards that reduce exposure windows. Vendors offering seamless cloud provider integrations and scalable licensing capture enterprise interest. Risk-based scoring and API-first designs create paths for platform expansion.

AI, predictive analytics and vertical specialization

AI and machine learning become central to prioritizing vulnerabilities by business impact. It enables predictive insights that guide limited security resources to the highest risk exposures. Sector-specific solutions for BFSI, healthcare, and energy present strong growth opportunities due to unique compliance and operational needs. Managed services and SME-focused packages broaden addressable markets where in-house skills are scarce.

Market Challenges

Fragmented IT estates and integration gaps

The Vulnerability Management (VM) Market faces hurdles from complex, heterogeneous IT environments that reduce unified visibility. Legacy systems, OT/ICS components, and disparate tools complicate consistent scanning and accurate prioritization. It increases false positives and slows remediation cycles. Vendors must invest in broad protocol support and mature integrations to deliver reliable coverage across on-premises and cloud assets.

Skills shortage and implementation cost pressures

A global shortage of experienced cybersecurity professionals limits effective deployment and tuning of VM platforms. It forces reliance on automation, yet human oversight remains necessary for context and decisioning. Smaller organizations confront budget constraints that restrict access to enterprise-grade tools. It creates demand for simplified, managed, and SaaS offerings that reduce operational overhead while maintaining adequate protection.

Key Players

· Microsoft

· Qualys

· Tenable

· Rapid7

· Ivanti

· Tripwire

· Symantec (Broadcom)

· McAfee

· Fortinet

· BeyondTrust

Regional Insights

North America 38%

North America leads with 38% share, driven by strict regulations, mature infrastructure, and high security spending.

Europe 27%

Europe holds 27% share; GDPR and NIS2 push enterprises to adopt robust, compliance-centric vulnerability solutions.

Asia Pacific 22%

Asia Pacific commands 22% share and shows fastest growth due to rapid digitalization and expanding cloud adoption.

Latin America 7%

Latin America accounts for 7% share, with rising cybercrime and growing awareness driving steady investments.

Middle East & Africa 6%

Middle East & Africa capture 6% share; national cybersecurity initiatives and infrastructure projects spur adoption.

Competitive Analysis

The Vulnerability Management (VM) Market remains competitive with Microsoft, Qualys, Tenable, Rapid7, Ivanti, Tripwire, Symantec, and McAfee shaping product roadmaps and go-to-market plays. Vendors differentiate through AI-enabled risk scoring, cloud integrations, and automated remediation workflows. Strategic partnerships, M&A, and developer ecosystem integrations expand capabilities and customer reach. It forces continuous feature refresh and pricing flexibility to win both enterprise and SME segments, while managed service models target customers with limited internal security skills.

Go-To Market Strategy

Position the Vulnerability Management (VM) Market offering around three pillars: rapid time-to-value, integration simplicity, and risk-based outcomes. Target enterprise buyers with deep technical pilots that demonstrate automated remediation and compliance reporting. Sell SaaS and managed tiers to SMEs to lower adoption friction. Build channel partnerships with MSSPs and cloud providers to scale distribution. Invest in developer tooling and DevOps integrations to capture security-by-design buyers. Use case studies from BFSI and healthcare to prove ROI and shorten procurement cycles.

Recent Development

· 2025 - Tenable introduced AI enhancements for automated threat prioritization and risk scoring.

· 2024 - Rapid7 launched Attack Surface Management modules and expanded Command Platform features.

· 2024 - Microsoft expanded vulnerability scanning across multicloud and hybrid environments within Defender.

· 2024 - Qualys advanced FedRAMP High authorizations and strengthened policy compliance capabilities.

· 2024 - Vendors increased investment in cloud-native and AI-driven VM features to address hybrid workloads.

Future Outlook

AI-driven risk-based platforms will dominate procurement decisions, enabling security teams to prioritize vulnerabilities by business impact. Cloud-native tools and continuous monitoring will become standard, while managed services expand to cover SMEs lacking internal expertise. Integration with DevOps and extended detection ecosystems will shorten remediation cycles and reduce exposure windows. Regional growth will concentrate in Asia Pacific and GCC nations, driven by digitalization and regulatory uplift. Vendors that deliver modular pricing and rapid integrations will capture the largest share.

Frequently Asked Questions

What is the current market size of the Vulnerability Management (VM) Market?

The market was valued at USD 17.47 billion in 2024.

What is the expected CAGR for the Vulnerability Management (VM) Market?

The market is projected to grow at a CAGR of 9.1% through 2032.

Which region leads the Vulnerability Management (VM) Market?

North America leads with approximately 38% share in 2024.

Who are the major players in the Vulnerability Management (VM) Market?

Key players include Microsoft, Qualys, Tenable, Rapid7, Ivanti, and others.

Source: https://www.credenceresearch.com/report/vulnerability-management-market