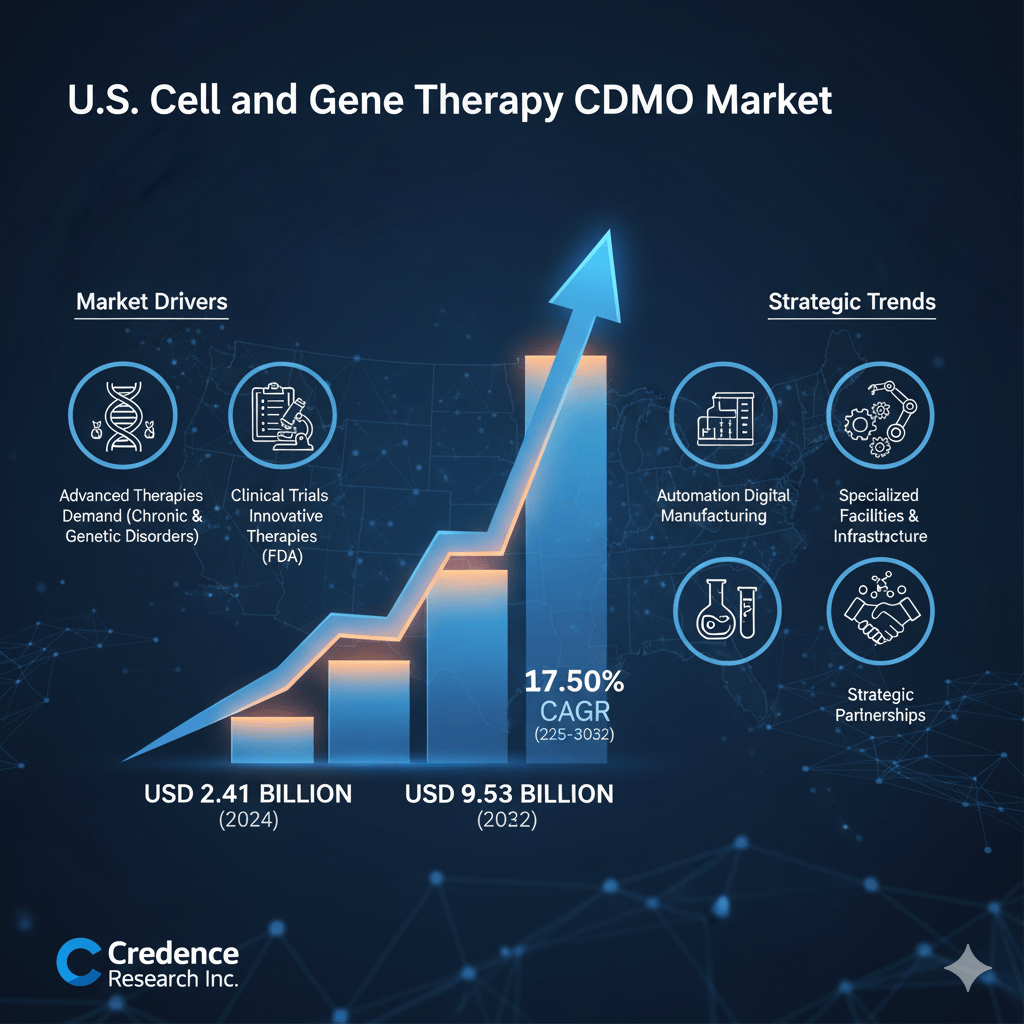

The Untappable Surge: U.S. Cell and Gene Therapy CDMO Market Poised for $9.5 Billion Breakthrough by 2032

The U.S. Cell and Gene Therapy CDMO Market is driving a revolution in personalized medicine, projected to skyrocket from $2.41 billion in 2024 to $9.53 billion by 2032, exhibiting a robust 17.50% CAGR. This explosive growth is fueled by critical factors like the escalating number of clinical trials, strategic outsourcing for specialized expertise, the adoption of advanced biomanufacturing automation, and a supportive regulatory environment. Discover how leading CDMOs and biotech firms are navigating complexity and accelerating life-changing therapies to patients. (Credence Research Inc.)

The New Frontier in Medicine: U.S. Cell and Gene Therapy CDMO Market on an Exponential Growth Trajectory

The landscape of modern medicine is undergoing a profound transformation, with Cell and Gene Therapies (CGTs) emerging as a true paradigm shift from traditional pharmaceuticals. These complex, often curative treatments for rare genetic disorders and chronic diseases are redefining patient care. At the heart of this revolution is the U.S. Cell and Gene Therapy Contract Development and Manufacturing Organization (CDMO) Market, an indispensable ecosystem that is enabling the leap from scientific discovery to commercial reality.

According to a comprehensive market analysis by Credence Research Inc., the U.S. CGT CDMO market is experiencing an explosive growth phase. Valued at USD 759.18 million in 2018, the market size soared to USD 2,407.80 million in 2024 and is now anticipated to reach a staggering USD 9,531.51 million by 2032, advancing at an impressive Compound Annual Growth Rate (CAGR) of 17.50% over the forecast period (2025-2032). This projected quadrupling of market value over the next eight years underscores the critical and expanding role of CDMOs in bringing these next-generation medicines to the millions of patients who desperately need them.

Source: https://www.credenceresearch.com/report/us-cell-and-gene-therapy-cdmo-market

Market Drivers: The Forces Propelling Outsourcing and Innovation

The robust expansion of the U.S. Cell and Gene Therapy CDMO Market is underpinned by a confluence of powerful drivers:

1. Rising Adoption of Outsourced Expertise to Accelerate Biopharma Development

The inherent complexity of manufacturing cell and gene therapies—which involves live, highly sensitive biological materials like viral vectors and genetically modified cells—requires specialized facilities and technical know-how that most biotech and pharmaceutical companies lack in-house. This manufacturing complexity, coupled with the high capital expenditure required to build and maintain compliant infrastructure, creates a strong economic imperative for outsourcing. CDMOs offer a turnkey solution: access to state-of-the-art facilities, specialized technical expertise, and established regulatory compliance frameworks.

By leveraging these outsourced partnerships, biopharma firms can significantly reduce development timelines, optimize manufacturing costs, and focus internal resources on core R&D activities. The growing pipelines of both established and emerging therapies have created an urgent demand for scalable, high-quality production, placing CDMOs squarely at the center of the innovation and commercialization engine.

2. Expansion of Clinical Trials and Rapid Growth in Innovative Therapies

A massive and growing pipeline of clinical-stage CGTs is fueling the CDMO market. The increasing number of clinical trials, particularly for oncology and rare diseases, necessitates specialized manufacturing services across all phases, from pre-clinical process optimization to late-stage commercial supply. The market insight confirms that the clinical segment dominates with a 76% share by phase, reflecting the extensive late-stage trials and commercial activity currently underway. The pre-clinical segment, accounting for 24%, highlights the crucial role CDMOs play in early-stage development and process scale-up.

This clinical surge creates strong, sustained opportunities for CDMOs to support the journey from Investigational New Drug (IND) application through to Biologics License Application (BLA). Partnerships with CDMOs, such as Lonza’s extensive licensing and support activities, become essential for biopharma companies seeking proven ability to deliver Good Manufacturing Practice (GMP)-compliant products for regulatory approval.

3. Regulatory Support and Evolving Quality Standards Supporting Growth

The U.S. market benefits significantly from a favorable regulatory climate. Agencies like the FDA have established accelerated pathways (such as Regenerative Medicine Advanced Therapy, or RMAT) to fast-track innovative therapies for unmet medical needs. This supportive framework encourages biopharma firms to partner with CDMOs that can navigate the rigorous and constantly evolving quality standards.

The establishment of the FDA’s new “super office,” the Office of Therapeutic Products (OTP), is a direct response to the surge in CGT applications, aiming to provide more consistent and timely advice to sponsors. For instance, the approval of WuXi Advanced Therapies’ Philadelphia site to manufacture and test the first individualized T-cell therapy for solid tumors demonstrates how regulatory clarity and approvals directly strengthen market growth and enhance investor confidence in CDMO capabilities.

4. Rising Incidence of Genetic Disorders and Chronic Diseases Fueling Demand

The fundamental market driver is the increasing global prevalence of chronic diseases and rare genetic disorders. The high burden of these conditions demands new treatment approaches beyond traditional small-molecule drugs. Cell and gene therapies, with their potential for curative outcomes, are positioned as transformative solutions. This massive patient need aligns directly with CDMOs that can offer scalable, high-quality production for diverse therapeutic modalities. This dynamic ensures that CDMOs remain vital, indispensable contributors to global healthcare advancements.

Strategic Trends: Modernizing the CGT Manufacturing Landscape

Beyond the core drivers, the U.S. Cell and Gene Therapy CDMO Market is defined by several transformative trends:

-

Growing Use of Automation and Digital Technologies: To overcome the inherent inconsistencies and labor-intensive nature of cell-based manufacturing, CDMOs are heavily investing in automation and digital systems. The deployment of robotics, AI-driven analytics, and digital twins is streamlining production, reducing human error, minimizing downtime, and ensuring higher reproducibility and data integrity critical for GMP compliance. This shift is essential for achieving the industrial scale required for commercial success.

-

Rising Investments in Specialized Facilities and Advanced Infrastructure: To meet the surging demand, CDMOs are in an arms race for capacity. This involves building sophisticated, modular cleanrooms, high-capacity viral vector suites, and flexible bioreactor systems. Strategic investments, such as Catalent’s $230 million expansion of its gene therapy campus, are focused on creating end-to-end commercial manufacturing capacity, enabling quick adaptation to diverse client requirements and managing complex, multi-product pipelines.

-

Emergence of Strategic Partnerships and Industry Collaborations: The market is characterized by a rise in strategic alliances between CDMOs, biotech firms, and academic institutions. These industry collaborations allow for the sharing of risks, resources, and specialized expertise, accelerating innovation and strengthening the capacity for both clinical and commercial supply chain reliability.

-

Increasing Focus on Personalized and Patient-Centric Therapies: The shift toward personalized medicines, particularly autologous therapies like CAR-T, requires manufacturing models that can accommodate small-batch, highly specific, and complex workflows. CDMOs are adapting by developing fully integrated, closed-process manufacturing platforms such as those pioneered by WuXi Advanced Therapies that standardize key steps and reduce turnaround times, thereby enabling more predictable and accelerated GMP manufacturing timelines for individualized treatments.

Geographical and Segment Leadership

Geographically, the U.S. remains the undisputed global leader in the CGT CDMO space, powered by its robust biotechnology ecosystem and favorable regulatory framework. The market is not homogenous, with key regional concentrations:

-

Northeast (38% Share): Dominates the market, driven by established biotech clusters, world-class research hubs, and significant capital investment in states like Massachusetts.

-

Midwest (27%) and West (22%): Also hold top shares, with the West benefiting from the San Francisco Bay Area and San Diego biotech centers.

-

South (13% Share): Emerges as the fastest-growing region, fueled by significant infrastructure expansion, new clinical trial networks, and rising private and public investments in states like Texas and North Carolina.

In terms of phases, the dominance of the clinical segment (76%) highlights the current demand for late-stage and commercial-scale manufacturing, while the substantial share of the pre-clinical segment (24%) emphasizes the importance of early-stage process development and optimization offered by CDMOs.

Conclusion

The U.S. Cell and Gene Therapy CDMO Market is more than just a service sector; it is the crucial CDMO biomanufacturing backbone supporting the next generation of medical breakthroughs. The market’s anticipated ascent to over $9.5 billion by 2032, as forecast by Credence Research Inc., is a clear indicator of the permanent shift in the biopharma industry towards outsourcing complex manufacturing. Driven by increasing demand for advanced therapeutics, favorable regulatory pathways, and a strong trend towards automation and strategic capacity expansion, CDMOs are enabling biotech innovators to navigate the development path efficiently and deliver life-changing, and often curative, treatments to patients faster than ever before. This is an untappable surge that promises to reshape global health.

Source: https://www.credenceresearch.com/report/us-cell-and-gene-therapy-cdmo-market